Maximizing Efficiency and ROI: Key Insights from NRF 2024

The IDC Retail Insights Team joined attendees from technology and retail companies at Javits Convention Center in New York City for NRF 2024: Retail’s Big Show. The event, which took place from January 14 through January 16, saw 40,000+ attendees, topping the over 30,000 visitors of last year’s edition.

At the show, we engaged in 200+ meetings with technology vendors to learn more about their offerings and discuss the latest trends in retail technology. The theme of operational efficiency and the focus on use cases and technologies that generate return on investment (ROI) permeated the discussions we had with delegates.

Some of the key points gathered during our conversations include:

- “Sensible” approach to Generative AI applications: We were expecting a lot of conversations around Generative AI (Gen AI) this year. We weren’t disappointed. But the approach taken by tech vendors and retailers focused on use cases that generate ROIs and provide value to customers, rather than on the application of the technology per se.

For example, leveraging Gen AI to build content for coding, to create and enrich product descriptions, for content supply chain, for product reviews, etc., came out regularly in our conversations with vendors when asked what retailers are looking at in terms of Gen AI applications.

- AI-driven organizational changes: Challenges related to the implementation of Gen AI were also touched. One vendor said that this year is going to be the year of the proliferation of Gen AI models, and retailers will need guidance from vendors. Managing and cleaning data that feeds into Gen AI is also another challenge retailers face.

Also, change management is to become key in organizations expanding Gen AI applications. The technology is likely to augment, rather than replace, employees, but require a cultural change within organizations.

- AI-driven changes in consumer dynamics: Related to AI, discussions around generative search and contextual buying were fascinating. This approach brings a systemic change in the way shoppers search for products online, moving away from searching by single products to searching by context.

For example, instead of looking for specific grocery items, shoppers will be able to ask the search engine to come up with a list of items they can buy if they want to put together a healthy meal for the family based on the available budget. AI also brings increased customer experience personalization, such as in pricing and promotions, enabling brands and retailers to offer bespoke discounts and product recommendations to shoppers based on their personal preferences and the status of the customer journey.

- Values-driven customer data and loyalty: In today’s cookiesless era, data is the golden reserve of every brand and retailer. For this reason, retaining and increasing loyalty and loyal customers is a critical priority of customer experience.

Loyalty is intrinsically driven by trust and contextual personalization and results in customer lifetime value and customer satisfaction. Thus, retailers and brands are offering to customers multi-loyalty programs, and as we predict, this is expected to involve 40% of retailers globally over the next two years.

By launching multi-loyalty programs, retailers can offer multi-level/membership to customers, who can improve their status to “VIP/exclusive” stages, accessing personalized experiences. At the same time, retailers can be a partner ecosystem enabler of loyalty, where customers can accrue and redeem reward points across sectors (from hotels and shopping malls to grocery stores and fuel stations).

- The evolution of the physical store: Far from being anything new, but the physical store remains central in Retail. According to our research, more than 60% of retail revenues are generated via the physical store in 2023. The focus at NRF was on how to augment the role of the physical store, enhancing a frictionless shopping experience, increasing its efficiencies, and integrating with the digital shopping journey.

Unsurprisingly, AI was front and centre in the conversations related to the store, with applications including computer vision for faster and more efficient item recognition and pricing at self-checkouts, and for shrinkage prevention and traffic and customer behaviour analytics.

But a less expected, big comeback this year was the RFID technology, as its application has become economically viable in subsegments including apparel and fashion retail, enabling seamless scanning and payment for items at self-checkout or through cashierless scan-and-go, easier in-store returns and more effective loss and shrinkage prevention.

- Commerce platforms become unified: the theme of composability was unsurprisingly front and centre of our conversations on commerce platforms with technology vendors. Some 77% of retailers describe their commerce architecture as composable, according to our research.

Composability offers key advantages including greater flexibility, customization, and scalability, making it the preferred choice for many brands and retailers that need the ability to continuously respond to today’s fast-evolving market. Platform providers stress the importance of composable platforms to enable integration with partners’ services.

One recurring theme this year was the expansion of channel-less capabilities of digital commerce platforms, as many vendors highlighted their plans to expand capabilities including mobile POS apps or facilitate integrations with partners that provide POS. This signals how the persistent importance of the physical store noted above is also shaping the modernization and consolidation of applications and solutions into a unique platform, conceived to serve the rapid growth of digital commerce in recent years.

- Alternative approaches to returns: Many of our conversations with attendees revolved around the issue of returns. One of the greatest challenges in today’s omnichannel retail is to effectively manage the last mile, both for order fulfilment and returns.

The approach that we saw emerging in the conversation with technology vendors revolved around the need for retailers to limit the need for returns, on top of making those that occur the most efficient and frictionless as possible. For example, leveraging Gen AI to enhance product description reduces the likelihood of shoppers returning items as they receive something that doesn’t match their expectations.

Another approach we saw was the “weaponization” of returns, that is the use of returns as an occasion to create better engagement with shoppers and upsell, for instance by enabling shoppers to trade in unwanted items for credits to buy something else, facilitating a seamless re-commerce cycle.

Another approach to ease the impact of returns on retail operations is the personalization of returns, that is offering better return terms to valuable shoppers. For example, brands and retailers—particularly in segments selling high-value items such as luxury goods—partner with rapid delivery services to offer rapid returns to high-value customers.

- Expansion of the marketplace: The marketplace model is gaining momentum. Over 23% of retailers’ revenue was generated by digital channels including marketplaces in 2023. But the trend is not limited to retail.

In a few conversations at NRF, it was interesting to see the growth of marketplaces outside retail B2C to offer one-stop-shop experiences to customers in finance, travel, B2B, etc., as more companies outside retail turn to technology providers and consultants to expand their offering through the channel, and to gather intelligence on what items and services, including those offered by partners, sell best.

NRF 2024 was a great opportunity to engage with technology vendors and learn about the latest trends in retail technology. The key message emerging from the event is that retailers need to continuously embrace change to stay ahead of the competition, but they need to do so by ensuring that efficiency and profitability are safeguarded and enhanced.

What we highlighted above, including the focus on Gen AI that generates ROIs, AI-driven changes in organizations and consumer dynamics, the creative approaches to returns, and the developments in physical and digital commerce, are just a few of the many trends that are shaping the future of retail. Brands and retailers should take note of these trends and consider how they can leverage them to improve their businesses, start exploring these trends, and experiment with different use cases and technologies to stay ahead of the curve.

If you want to know more, please reach us out at fbattaini@idc.com or ourso@idc.com.

AI Is Accelerating PropTech Innovation

Strong Headwinds Disrupting the Built Environment Industries

The built environment sector is often seen as a laggard in productivity and technology adoption. However, this is changing: the strong headwinds of the last few years have forced companies to evolve and innovate.

The pandemic led to widespread supply chain shocks felt acutely by the construction sector and with geopolitical tensions increasing, including in the Red Sea, this issue is here to stay. Covid-19 also led to one of the largest shake ups in the real estate industry with significant drops in office occupancy rates in the move back to hybrid work.

While occupancy rates are recovering, they are not expected to return to pre-pandemic levels. Add to this potent mix, the energy crisis and increasing ESG targets and regulatory requirements.

PropTech Companies Are Injecting Innovation

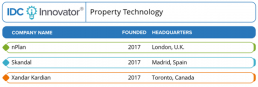

Property technology (PropTech) companies are injecting much-needed innovation into the industry and driving significant changes across building life cycles from design to construction, operation, maintenance, and demolition. We have published a PropTech Innovator Report highlighting 3 Innovate companies that are providing transformative solutions across the built environment sector.

In line with the AI era, which IDC refers to as to as AI Everywhere, each Innovator highlighted in the report is leveraging AI in their solutions.

Our research highlights that the top priorities for built environment executives are improving operational efficiency and cost reduction, enhancing environmental sustainability and improving resilience to climatic hazards. Organizations are increasingly applying technology to help support these business objectives.

For example, to meet their sustainability goals, 66% of real estate companies are investing in data and analytics including AI, and 61% are investing in space and workplace technology (IDC’s Sustainable Buildings, Homes, and Districts Survey, 2023, n = 654).

Announcing IDC’s “Worldwide PropTech Innovators, 2023”

The PropTech companies highlighted in the Innovator span the building lifecycle and reflect the diverse range of companies encapsulated in this market. The first innovator — nPlan — is changing the way in which major projects can be planned, designed, and monitored through an AI-enabled software solution drawing on over 750,000 project schedules. The second — Skandal — is providing IoT driven lighting displays that respond to building inhabitants to improve occupant experience and promote behavioral change. Finally, Xandar Kardian’s solution monitors occupant motion through the innovative use of radar technology and can also monitor resting heart rate and respiratory rate for applications in health and social care facilities.

IDC is developing further Innovator reports focused on innovation in the built environment so please get in contact if you are an SME and meet the eligibility criteria – jdignan@idc.com lbarker@idc.com

You may also be interested in:

River Cities: Using Technology and Smart City Thinking to Instrument Rivers

How France is Using Technology to Improve Their Rivers

Globally, cities are rediscovering the importance of their rivers as a central tenet of the health, wellbeing, and economy of a city. A river was often, if not always, the reason for a city to develop and grow, but during the 20th century city, authorities began to focus primarily on the built environment and to see water management as a less important sub issue of city management.

With the rise of environmental awareness in the 21st century, cities are beginning to relook at the interrelationship between the built environment and their rivers. We have been tracking this new direction through their research on River Cities and how technology now allows us to instrument both water and the built environment in concert.

According to our research, 28% of local governments across EMEA are already investing in smart rivers with an additional 29% considering investing in the future (IDC Survey, December 2023).

The French are Reclaiming their Rivers

France is emerging as a leader in this process, and the clearest example of this will be the opening ceremony of the 2024 Olympic Games.

Paris is the most visited city in the world, and it is impossible to imagine Paris without picturing the Seine. Olympic opening ceremonies are historically held in a stadium, but France will be using the banks of the Seine for the ceremony to increase participation and celebrate the special relationship between the river and the city.

The Digital Twin Project

A further French example of this new thinking is captured in a recently published IDC Perspective Building a River Digital Twin: A Case Study of the Port de Bordeaux. This document provides an overview of a project led by the Port de Bordeaux, an entity managing marine activities across Bordeaux and the Gironde Estuary.

The objective of the project is to create a digital twin of the Estuary – the largest Estuary in Western Europe covering around 635 km2. The Gironde Estuary is formed from the meeting of the rivers of Dordogne and Garonne and spans several cities, the main one being Bordeaux with more than 250k residents. The Port de Bordeaux manages 7 terminals is the 7th largest French port in terms of traffic.

The digital twin was built to help project participants in both their day-day tactical decision-making process (for example, information on water levels, pollution and navigation) as well as addressing longer-term and strategic challenges (adaptation and impacts of climate change). The Port de Bordeaux developed 8 core goals for the digital twin project:

- Sharing and developing knowledge of the river.

- Promoting the exchange of data and operational results.

- Anticipating the effects of climate change.

- Identifying mitigation solutions.

- Developing economic, recreational and tourism opportunities.

- Preserving biodiversity and environmental wealth.

- Developing coastal and river surveillance (alert systems).

- Fostering replicability of the platform on other rivers.

An innovative aspect of this project is that the project team looked beyond environmental challenges to a broader set of objectives, including, for example, economic and recreational activities. This approach is centred on the view of a river as a complex ecosystem of different stakeholders and an integral part of the identity of the region. The project has a wide target audience, and the use cases, outputs and goals were co-created with the relevant stakeholders at the design stage.

Digital twins are at an early stage of adoption for rivers and marine environments. However, the application of technologies to the blue economy is increasing.

We predict that, by 2027, threatened by water scarcity and extreme weather, 40% of large cities will have digital twins of their water resources to manage water supply, quality, resilience and behavioural change (IDC Smart Cities and Communities 2023 Futurescape).

The Port de Bordeaux is an early adopter and can provide a model and blueprint for others to follow as a core principle of the project was making as many aspects as possible open source. Local stakeholders can upload their own data and use the GIROS platform to visualize their results. This supports a broader community of users being able to take advantage of the model.

Crucially, the Bordeaux project team intentionally designed the solution to be replicable on other rivers; while the numerical model for the Gironde is geographically specific, the framework and architecture of the solution is being made publicly available.

We are soon to publish our first Tech Innovator report on companies involved in rivers and water management and are keen to hear of innovative technology solutions and case studies involving river management for future reports so please do get in touch with us jdignan@idc.com, lbarker@idc.com, rletemple@idc.com

The New Era of FinOps and GreenOps: From Cloud Cost to Sustainability to Business Value

Welcome to the era of xOps where the focus is on sharpening operations capabilities – ranging from visibility to governance to optimization and efficiency for maximizing the business value.

Cloud investments continue to be critical for most organizations, but many are shifting focus to a holistic approach of migration, operations, and optimization under the strategy of CloudOps and governance that also extends to FinOps and GreenOps.

The Ops focus is to optimize and manage applications and services in hybrid cloud through a complex, automated, and governed approach. The goal is to leverage intelligence and AI capabilities to get faster insights into operations to improve efficiency as well as reduce costs and carbon footprint.

Beyond GenAI, cloud costs optimization and sustainability have captured our attention in every conversation with European end-users and cloud vendors in 2023. While cloud costs optimization practices (FinOps) are becoming the norm, sustainability operations (GreenOps) are still at an early stage of maturity, but with Europe leading the path.

This extended focus on GreenOps builds on last year’s FinOps focus highlighted in IDC blog: The Era of FinOps: Focus is Shifting from Cloud Features to Cloud Value.

Why Europe?

European organizations are facing macro-economic uncertainties including inflation, talent-gap, climate crisis, and contention in Eastern Europe. In addition, the new European regulations around sustainability that enter into force in January 2024 (CSRD and ESRS), along with the increasingly sustainability awareness among the young European generation, further puts cloud vendors under pressure.

As a result, IDC’s European CloudOps survey, 2023 (N=1,057) showed that sustainability (37%) and FinOps (31%) are the top two areas that organizations have identified for investment to optimize their cloud operations. We are expecting these results to be even more markable in 2024.

The Future of FinOps and GreenOps in 2024 and Beyond

FinOps and GreenOps remain to be critical in 2024 and beyond. In fact, we expect that by the end of this year, cloud costs and complexity will drive 65% of large organizations in EMEA to increase their maturity with optimization practices, resulting in 2X greater efficiency and cost effectiveness than all organizations.

We believe there are huge opportunities for cloud vendors in both spaces. Enabling organizations with FinOps capabilities can help customers get a better understanding of their cloud spending trends in order to optimize the spend, bring transparency and accountability, and boost ROI from investments.

GreenOps, on the other hand, can bring capabilities to reduce the environmental footprint in the cloud. GrenOps also involves practices like waste reduction, switching off resources, and the transition to renewable energy, but also promoting a new company culture with a greater environmental responsibility.

Conclusion

Despite different objectives, the two approaches must go hand in hand as one is a big contributor to the other, and vice versa. The CloudOps community also agreed that providing granular data across cloud costs and carbon footprint (scope 1, 2, and 3), along with tailored insights and recommendations, would play a critical role in enhancing cloud vendors’ competitive advantage.

Furthermore, cloud providers need to be meticulous in measuring data, sharing what they have included and excluded, and providing data metrics. Finally, cloud vendors should also educate stakeholders, especially in less mature markets like GreenOps, resulting in a greater trust with their customers.

Stay tuned on the new EMEA CloudOps research and survey and join us on Tuesday, January 23rd, at 11am GMT, where we will discuss the new IDC FutureScape 2024: European Cloud, including trends and opportunities around FinOps and GreenOps.