Lessons on Sustainable Tourism from an Unexpected Source: Saudi Arabia

Saudi Arabia is making good on its ambition to become a global smart and sustainable tourist destination.

Not long ago, however, such an outcome seemed unlikely. When we traveled from Europe to the kingdom in 2015, for example, we were required to prepare piles of documents months in advance. We also had to make a trip to a Saudi visa application center, which existed in only a handful of European cities.

Getting through passport control at King Khaled International Airport meant standing in line for at least an hour. The quickest way to get to town was via a pre-booked car service, which invariably came in the form of a gas-guzzling SUV. After arrival in Riyadh, the entertainment options were slim.

But now, nine years later, the immigration process and airplane boarding can take literally a blink of an eye. This reflects the Saudi aviation industry’s investments in growth, customer experience, and operational excellence.

Commuting to Riyadh also comes in all shapes and forms of private transportation — and public transit is on the way. The city buzzes with museums, theaters, concerts, sport events, and Michelin star restaurants. It will host, along with partner cities across the country, the Asian Winter Games 2029, as well Formula 1, Formula E, the Dakar Rally, World Expo 2030, and the FIFA World Cup in 2034.

Obviously, these rapid changes did not occur accidentally. They are the fruits of an ambitious vision to enhance the country’s social fabric and lay the foundation for a diversified economy that leverages the full spectrum of its population’s talents and contributions. Saudi Arabia aspires to reduce its dependence on oil and ensure economic resilience by cultivating sectors such as tourism and entertainment.

Bold Vision — Sustainable Execution

The government’s Vision 2030 marks a pivotal chapter in the history of the kingdom, signaling a transformative shift towards the goals of openness, cultural evolution, and economic diversification. Travel, tourism, and entertainment are strategic priorities in this economic diversification and social reform road map.

The Digital Tourism Strategy aims to boost tourism’s contribution to GDP from 3% to 10% by 2030 and to increase the number of foreign visitors from around 60 million to 100 million annually by 2030. Investments are already paying off.

Since the opening of its doors in 2019 to international tourists, the kingdom has become the fastest growing tourism destination in the G20.

But the ambition extends beyond growth of the tourism industry. Giga projects like Neom, Diriyah, and Red Sea — backed by the $600 billion Public Investment Fund (PIF) — are being developed not only to increase capacity to host new residents, visitors, and global events, but also to reimagine the quality of life and the cultural, heritage, leisure experiences, environmental sustainability, and innovation expectations of next-generation tourists.

Saudi Arabia seeks to explore “the art of the possible” in terms of eco-friendly tourism, architectural design, and green technologies. The kingdom seeks to align these developments with the United Nations’ Sustainable Development Goals. The aim is to pioneer a responsible tourism model that safeguards the country’s rich natural and cultural heritage while fostering economic prosperity and improving Saudi quality of life.

By 2030, the kingdom plans to reduce by 50% the carbon emissions generated by the tourism industry. In parallel, it is creating wildlife sanctuaries and developing sustainable tourism initiatives that protect endangered species and the natural landscape. Planned developments at the Red Sea project are an example of authorities’ regenerative environmental approach.

Saudi Arabia largely imports its food from abroad and is running out of water. To address this, Neom plans to become food self-sufficient and source water from carbon-free desalination plants. Some resorts are exploring the concepts of biomimicry and developing nature-based architectural designs.

To accelerate the execution of such an ambitious vision, Saudi public institutions and private investors are working closely with local and global technology companies to empower them to reimagine the visitor experience and operational excellence in a sustainable manner.

Sustainable Tourism: Powered by Tech Innovation

The Saudi Tourism Authority’s (STA) traveler-centric approach and ambition to develop personalized experiences for visitors is a major differentiator from other destinations. Visitors who share their interests and preferences, for example, can receive customized recommendations during their stay in the kingdom. For world sports events like Formula E, guests can enjoy immersive experiences.

Digital technology is also powering Saudi Arabia’s long-standing tradition of hosting the annual religious pilgrimages of Hajj and Umrah, with a range of apps offered to enhance the safety and experience of millions of pilgrims from around the globe.

Plans also call for the building and operation of digital-by-design entertainment facilities that leverage digital twins and metaverse-centric solutions. These require partnering with technology companies that can deliver next-generation digital infrastructure, platforms, and user experience capabilities that align with the kingdom’s sustainable tourism and entertainment agenda.

To execute these ambitious visions, local and global technology vendors need to partner with the senior leaders driving the giga projects, as well as with national authorities like the STA and the Authority for Data and AI (SDAIA), which serves as a strategic decision maker for Saudi aspirations to leverage AI to enhance smart tourism destinations. Technology vendors and advisors can also help the kingdom leverage international best practices, such as the UNWTO framework, and to set the baseline and measure progress against sustainable tourism targets.

From personalized travel experiences to efficient resource management and environmentally and socially responsible engineering and construction supply chains, Saudi Arabia is being watched by global leaders who are also reimagining and developing new standards for sustainable tourist destinations.

Tech innovation will be critical to execute such an ambitious vision while confronting a demographic boom and limited natural resources — all while keeping a human touch that allows tourists as well as citizens to enjoy the fruits of these developments.

From e-Government to Invisible Government Bureaucracy

Making government services more people-centric is not a new aspiration, but with fast advances in technology and rising societal expectations, public sector senior leaders are re-imagining how to deliver on that promise.

Since the inception of e-government in the early 2000s (later also known as smart government and digital government), making services available through digital channels became a critical instrument to improve citizen and business experience, as well as to attract investors and tourists, and collaborate with across government entities. These initiatives yielded results in terms of operational efficiency, convenience for and engagement with constituents.

Notwithstanding the progress, siloed processes and systems, forcing people and businesses to experience time-consuming bureaucratic services, and inequality of access to e-government services are still open issues.

Public sector leaders that aim to usher in the next generation of the people-centric services should understand people’s and businesses’ needs and circumstances through intelligent use of data, simplifying and joining up services across programs, partnering with the private sector, making digital services more inclusive, and enabling trusted interactions to make the bureaucracy truly “invisible”.

Reimagining Service Delivery, Operating and Trust Models

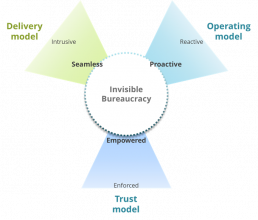

Making government bureaucracy invisible means embracing technology-powered innovation to drive proactive operations that will deliver seamless services for empowered people and businesses:

- Service delivery model. The next generation of invisible services will be seamless. Constituents (citizens, businesses, investors, tourists, etc.) will not realize that public services are being delivered. They will not be asked to interact with the government to know what services they are entitled to or be interrupted in their daily routine because they receive a request to provide data to prove changes in circumstances.

- Operating model. The next generation of invisible operations will be proactive. Without intruding into people’s and businesses’ daily lives, the government will know enough to understand the events that impact constituents and changes in circumstances. Governments will proactively register constituents for programs that they are entitled to and automatically deliver services.

- Trust model. The next generation of invisible bureaucracy will shift from enforcement to empowerment. Instead of enforcing compliance after the fact, the government will make compliance easy for constituents through automated, proactive services, and simplified regulations. Government will invest in digital trust through proactive, transparent personalized notifications, and tools to see how personal data is being used across departments.

The Road to Invisible Government Bureaucracy

To accelerate the road towards Invisible Government Bureaucracy, public sector senior leaders should implement changes around the six building blocks:

- Building a holistic view of people, businesses, and communities. To avoid asking for the same data again and again, to understand when a change in circumstances offers an opportunity for the government to proactively deliver a service, and to empower open engagement, governments are investing to build a 360° view of people, businesses, communities.

- Scaling cognitive processes and services. Governments need to re-engineer processes and embed AI-enabled cognitive capabilities into systems so that they can recognize changes in the circumstances of their constituents, identify root causes and trigger operational workflows or dynamically reconfigure services and programs to satisfy the evolving constituent needs.

- Designing and delivering people-centric experience journeys. Increasingly, people will expect to interact with systems through conversational interfaces that can recognize their language, accent, tone of voice, instead of having to scroll through screens and fill forms. Cognitive capabilities will be embedded in every touch points throughout the user experience journey.

- Ensuring accessibility and inclusion for all. The non-intrusive and proactive nature of the invisible government bureaucracy will also enhance inclusion by lowering accessibility the barriers. However, as conversational and generative AI, immersive reality solutions become more pervasive, they must be designed with accessibility in mind.

- Investing in next-generation trust services. The public sector should invest in digital trust tools that enable citizens to conveniently access digital services across government, without having to remember multiple login credentials. Such tools will help citizens have a transparent understanding on how government use personal data and opt-in or opt-out of data sharing.

- Expanding collaboration with third parties. Government are working with private enterprises and community organizations to enable constituents to enjoy the lowest possible number of interactions with the government, to eliminate duplicate request for personal data, and the best possible convenience and proximity when those interactions are needed.

The latest IDC Government Insights study explores how to adapt organizational capacity and competencies, revisit policies, work with the ecosystem, and ensure public trust, to make Invisible Government Bureaucracy a reality.

Maximizing Efficiency and ROI: Key Insights from NRF 2024

The IDC Retail Insights Team joined attendees from technology and retail companies at Javits Convention Center in New York City for NRF 2024: Retail’s Big Show. The event, which took place from January 14 through January 16, saw 40,000+ attendees, topping the over 30,000 visitors of last year’s edition.

At the show, we engaged in 200+ meetings with technology vendors to learn more about their offerings and discuss the latest trends in retail technology. The theme of operational efficiency and the focus on use cases and technologies that generate return on investment (ROI) permeated the discussions we had with delegates.

Some of the key points gathered during our conversations include:

- “Sensible” approach to Generative AI applications: We were expecting a lot of conversations around Generative AI (Gen AI) this year. We weren’t disappointed. But the approach taken by tech vendors and retailers focused on use cases that generate ROIs and provide value to customers, rather than on the application of the technology per se.

For example, leveraging Gen AI to build content for coding, to create and enrich product descriptions, for content supply chain, for product reviews, etc., came out regularly in our conversations with vendors when asked what retailers are looking at in terms of Gen AI applications.

- AI-driven organizational changes: Challenges related to the implementation of Gen AI were also touched. One vendor said that this year is going to be the year of the proliferation of Gen AI models, and retailers will need guidance from vendors. Managing and cleaning data that feeds into Gen AI is also another challenge retailers face.

Also, change management is to become key in organizations expanding Gen AI applications. The technology is likely to augment, rather than replace, employees, but require a cultural change within organizations.

- AI-driven changes in consumer dynamics: Related to AI, discussions around generative search and contextual buying were fascinating. This approach brings a systemic change in the way shoppers search for products online, moving away from searching by single products to searching by context.

For example, instead of looking for specific grocery items, shoppers will be able to ask the search engine to come up with a list of items they can buy if they want to put together a healthy meal for the family based on the available budget. AI also brings increased customer experience personalization, such as in pricing and promotions, enabling brands and retailers to offer bespoke discounts and product recommendations to shoppers based on their personal preferences and the status of the customer journey.

- Values-driven customer data and loyalty: In today’s cookiesless era, data is the golden reserve of every brand and retailer. For this reason, retaining and increasing loyalty and loyal customers is a critical priority of customer experience.

Loyalty is intrinsically driven by trust and contextual personalization and results in customer lifetime value and customer satisfaction. Thus, retailers and brands are offering to customers multi-loyalty programs, and as we predict, this is expected to involve 40% of retailers globally over the next two years.

By launching multi-loyalty programs, retailers can offer multi-level/membership to customers, who can improve their status to “VIP/exclusive” stages, accessing personalized experiences. At the same time, retailers can be a partner ecosystem enabler of loyalty, where customers can accrue and redeem reward points across sectors (from hotels and shopping malls to grocery stores and fuel stations).

- The evolution of the physical store: Far from being anything new, but the physical store remains central in Retail. According to our research, more than 60% of retail revenues are generated via the physical store in 2023. The focus at NRF was on how to augment the role of the physical store, enhancing a frictionless shopping experience, increasing its efficiencies, and integrating with the digital shopping journey.

Unsurprisingly, AI was front and centre in the conversations related to the store, with applications including computer vision for faster and more efficient item recognition and pricing at self-checkouts, and for shrinkage prevention and traffic and customer behaviour analytics.

But a less expected, big comeback this year was the RFID technology, as its application has become economically viable in subsegments including apparel and fashion retail, enabling seamless scanning and payment for items at self-checkout or through cashierless scan-and-go, easier in-store returns and more effective loss and shrinkage prevention.

- Commerce platforms become unified: the theme of composability was unsurprisingly front and centre of our conversations on commerce platforms with technology vendors. Some 77% of retailers describe their commerce architecture as composable, according to our research.

Composability offers key advantages including greater flexibility, customization, and scalability, making it the preferred choice for many brands and retailers that need the ability to continuously respond to today’s fast-evolving market. Platform providers stress the importance of composable platforms to enable integration with partners’ services.

One recurring theme this year was the expansion of channel-less capabilities of digital commerce platforms, as many vendors highlighted their plans to expand capabilities including mobile POS apps or facilitate integrations with partners that provide POS. This signals how the persistent importance of the physical store noted above is also shaping the modernization and consolidation of applications and solutions into a unique platform, conceived to serve the rapid growth of digital commerce in recent years.

- Alternative approaches to returns: Many of our conversations with attendees revolved around the issue of returns. One of the greatest challenges in today’s omnichannel retail is to effectively manage the last mile, both for order fulfilment and returns.

The approach that we saw emerging in the conversation with technology vendors revolved around the need for retailers to limit the need for returns, on top of making those that occur the most efficient and frictionless as possible. For example, leveraging Gen AI to enhance product description reduces the likelihood of shoppers returning items as they receive something that doesn’t match their expectations.

Another approach we saw was the “weaponization” of returns, that is the use of returns as an occasion to create better engagement with shoppers and upsell, for instance by enabling shoppers to trade in unwanted items for credits to buy something else, facilitating a seamless re-commerce cycle.

Another approach to ease the impact of returns on retail operations is the personalization of returns, that is offering better return terms to valuable shoppers. For example, brands and retailers—particularly in segments selling high-value items such as luxury goods—partner with rapid delivery services to offer rapid returns to high-value customers.

- Expansion of the marketplace: The marketplace model is gaining momentum. Over 23% of retailers’ revenue was generated by digital channels including marketplaces in 2023. But the trend is not limited to retail.

In a few conversations at NRF, it was interesting to see the growth of marketplaces outside retail B2C to offer one-stop-shop experiences to customers in finance, travel, B2B, etc., as more companies outside retail turn to technology providers and consultants to expand their offering through the channel, and to gather intelligence on what items and services, including those offered by partners, sell best.

NRF 2024 was a great opportunity to engage with technology vendors and learn about the latest trends in retail technology. The key message emerging from the event is that retailers need to continuously embrace change to stay ahead of the competition, but they need to do so by ensuring that efficiency and profitability are safeguarded and enhanced.

What we highlighted above, including the focus on Gen AI that generates ROIs, AI-driven changes in organizations and consumer dynamics, the creative approaches to returns, and the developments in physical and digital commerce, are just a few of the many trends that are shaping the future of retail. Brands and retailers should take note of these trends and consider how they can leverage them to improve their businesses, start exploring these trends, and experiment with different use cases and technologies to stay ahead of the curve.

If you want to know more, please reach us out at fbattaini@idc.com or ourso@idc.com.

AI Is Accelerating PropTech Innovation

Strong Headwinds Disrupting the Built Environment Industries

The built environment sector is often seen as a laggard in productivity and technology adoption. However, this is changing: the strong headwinds of the last few years have forced companies to evolve and innovate.

The pandemic led to widespread supply chain shocks felt acutely by the construction sector and with geopolitical tensions increasing, including in the Red Sea, this issue is here to stay. Covid-19 also led to one of the largest shake ups in the real estate industry with significant drops in office occupancy rates in the move back to hybrid work.

While occupancy rates are recovering, they are not expected to return to pre-pandemic levels. Add to this potent mix, the energy crisis and increasing ESG targets and regulatory requirements.

PropTech Companies Are Injecting Innovation

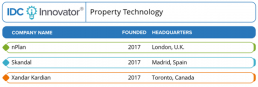

Property technology (PropTech) companies are injecting much-needed innovation into the industry and driving significant changes across building life cycles from design to construction, operation, maintenance, and demolition. We have published a PropTech Innovator Report highlighting 3 Innovate companies that are providing transformative solutions across the built environment sector.

In line with the AI era, which IDC refers to as to as AI Everywhere, each Innovator highlighted in the report is leveraging AI in their solutions.

Our research highlights that the top priorities for built environment executives are improving operational efficiency and cost reduction, enhancing environmental sustainability and improving resilience to climatic hazards. Organizations are increasingly applying technology to help support these business objectives.

For example, to meet their sustainability goals, 66% of real estate companies are investing in data and analytics including AI, and 61% are investing in space and workplace technology (IDC’s Sustainable Buildings, Homes, and Districts Survey, 2023, n = 654).

Announcing IDC’s “Worldwide PropTech Innovators, 2023”

The PropTech companies highlighted in the Innovator span the building lifecycle and reflect the diverse range of companies encapsulated in this market. The first innovator — nPlan — is changing the way in which major projects can be planned, designed, and monitored through an AI-enabled software solution drawing on over 750,000 project schedules. The second — Skandal — is providing IoT driven lighting displays that respond to building inhabitants to improve occupant experience and promote behavioral change. Finally, Xandar Kardian’s solution monitors occupant motion through the innovative use of radar technology and can also monitor resting heart rate and respiratory rate for applications in health and social care facilities.

IDC is developing further Innovator reports focused on innovation in the built environment so please get in contact if you are an SME and meet the eligibility criteria – jdignan@idc.com lbarker@idc.com

You may also be interested in:

River Cities: Using Technology and Smart City Thinking to Instrument Rivers