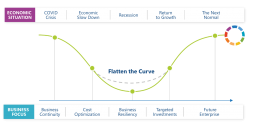

IDC’s vision of the “future enterprise” is an organization that is completely digitally transformed. Such an organization underpins business processes with technology, is fueled by innovation, and is platform-enabled and ecosystem-centric. The COVID-19 pandemic underscores the importance of digital transformation in the eyes of CEOs across all industries. But with a recession on the horizon, CEOs face a tough call — to follow the same course of cost cutting as in previous recessions or to use technology to flatten their own organizations’ recessionary curve.

Leverage Technology to Transition to the Next Normal

Where Are Organizations on the Road to Recovery?

According to the latest IDC COVID-19 Impact Survey, conducted in June among 730 organizations in Europe, the largest pool of organizations — 37% — are still in the business continuity stage (Stage 1) of the journey to the “next normal.” 33% are still in the cost optimization stage (Stage 2), while 18% are focusing on building business resiliency to drive profitability during the pending recession. The remaining 15% have already started their recovery journey and are working toward growth in the next normal. (Note that we are frequently asked for a timeline for these stages, but the reality is that every geography, industry, and organization will follow its own trajectory.)

Stage 1: COVID-19 Crisis — Business Continuity Is the Leading Business Priority

Whether we’re dealing with the current pandemic or the next shock to the global market, hyper-volatility will increasingly become the norm. Business continuity plans are already being rewritten — and will need to become a lot more dynamic as they are constantly tested and innovated.

C-suite narrative: “We’re in crisis mode. We’ve had to rip up our business continuity plans and look at everything from scratch.”

Organizations in this stage are desperately looking for new ideas, emerging best practices, and greater input from technology partners. This is not a time to push the product. More importantly, the support and help that technology partners provide in this period will be the basis for genuine long-term partnerships.

Stage 2: Economic Slowdown — Cost Optimization Is the Leading Business Priority

In this stage, organizations are in cost optimization mode, with businesses looking to technologies that can either help them manage the economic hardships or generate financial outcomes for the current fiscal year. These organizations look for financing assistance and/or opex options to manage their cashflows and working capital. Their decisions are driven by the short term as they seek projects that provide productivity gains and savings in cost-to-create or -serve.

C-suite narrative: “We’re in cost-saving mode and we’re prioritizing projects and programs that can tide us over during this challenging period. We’re not interested in exploring bleeding-edge technology use cases or jumpstarting any transformation program.”

Organizations in this stage tend to prefer technology vendors, SIs, and service providers that are closer to them — in both proximity and cultural alignment — and provide cheaper offerings, flexi-pricing and payment terms, or modular offerings.

Stage 3: Recession — Business Resiliency Is the Core Driving Force

In this stage, organizations have overcome the initial phase of the COVID-19 crisis and have stabilized their financials. Their focus now is on building business resiliency — adapting to changing circumstances while maintaining their central purpose. The purpose or mission articulated in the company’s digital transformation will remain a primary focus even as remediation actions are taken to reduce costs or take advantage of pandemic-related revenue opportunities.

Many organizations will recognize an opportunity to “flatten the curve” or minimize the impact of the recession on their organization by leveraging technology. These organizations will also double down in technology investments to emerge, on the other side of the curve, more resilient, more digitally fit, and ready to capture a greater share of the new opportunities.

C-suite narrative: “We’re ready to move our organization to the next level of response. We understand the criticality of technology and are reprioritizing our focus and investments to compete differently post-COVID-19. Adaptability and agility are our main thrust.”

Organizations in this stage tend to prefer technology vendors with established presence and delivery capabilities in their geographies and with the financial muscle to ride through the crisis. Access to the vendor’s product/capability road map is also important as organizations here are preparing for longer-term growth.

Stage 4: Return to Growth — Targeted Investments Are the Key Business Driver

At this stage, economic activity is returning to pre-crisis levels and companies are looking to invest more aggressively, but with a focus on technologies that advance their digital capabilities. As they get back on the path to being relevant in the digital economy, they will look back at their efforts around resiliency to ensure they are more prepared for a similar shock in the future.

IDC anticipates that corporate boards and government bodies will have a better understanding of the value of technology and will prioritize digital initiatives.

C-suite narrative: “We consider periods of market volatility as opportunities that well-prepared organizations can embrace and exploit.”

This will be a critical stage for technology vendors as organizations look for a safe place to innovate. Vendors that are financially healthy, have scale, and have robust ecosystems will be preferred. Vendors will earn strategic partnerships at the board level that will shape post-recession spending and permanently impact market shares.

Stage 5: The Next Normal — The Future Enterprise

When organizations come out of the recession, they will be operating in a new type of economy — the next normal. This will be the beginning of the digital economy with some new twists as a result of COVID-19. CEOs who have been consistently investing in digital transformation will be running the future enterprises and employing a digital enterprise agenda that centers on nine items (see below).

The CEO Agenda for the Future Enterprise

C-suite narrative: “Operating as a digital enterprise is vital to the success of our business. We will continue to invest in technology as it is a competitive advantage.”

Strategic vendor relationships are established during Stage 5, and the fortunate vendors that have won those positions must prove they can innovate with speed and scale to maintain them. Resiliency will remain a key expectation, not just to mitigate against a potential repeat of the pandemic but to enable companies to quickly recalibrate to the changing demands of customers, citizens, and patients.

Conclusion

Organizations’ response to COVID-19 will shape the perception of their brand and reputation over the next decade. As part of this, there needs to be a rethink of the core principles of how business operates.

In the short term, technology has proven to be a key enabler that has kept businesses afloat during the crisis by enabling remote work, agile business, and external digital engagement. In the longer term, organizations will leverage technology to underpin every single process, initiative, or value chain as they journey to the future state — the future enterprise.