The world is in distress. The COVID-19 pandemic has shaken our lives, our economies, and our social fabric. The ICT market has not been immune. IDC expects the market in Western Europe to contract 3.3% in 2020, returning to moderate growth of 0.9% in 2021, according to the latest IDC Worldwide Black Book forecast.

The overall market may look a little bleak, but if you zoom in on individual technologies, solutions, and services, opportunities do present themselves. This is especially true in cloud, security, and managed services. Though growth is forecast to be lower than in 2019, managed cloud providers can still look ahead with some optimism.

IDC has been running a buyer sentiment survey across key European markets every two weeks since the start of the pandemic, providing insight into buyer sentiment around managed cloud services (MCS), how use of cloud and related services is changing, and what buyers expect from their providers. We also carried out an MCS survey with 150 buyers and decision makers in Europe to explore how COVID-19 was affecting their decision making, road maps, and plans around MCS. The survey results have been published on IDC.com, but we wanted to share some key takeaways in this blog.

How COVID-19 is affecting plans around managed cloud services (MCS)

COVID-19 has forced many organizations to quickly adjust operations to respond to the new business reality: 26% of IT buyers believe MCS help them to build a resilience layer to deal with these sudden changes.

In these times of business uncertainty, there is pressure to improve business agility, and cloud-based solutions can be the platform to meet these demands and support digital transformation. And of course, increased demand for cloud has spurred a corresponding increase in demand for MCS, creating opportunities for service providers.

- MCS are a powerful tool for customers responding to COVID-19. Managed cloud services have been helping to deliver critical business and technology requirements during the pandemic. Among Western European companies, 26% see managed services as a tool to build an additional layer of business resiliency to protect against sudden shocks, and they have benefited from MCS providers’ ability to meet increased demand due to COVID-19.

- Customers seek a wider array of services. Customers want MCS providers to expand their service lines — managed security for remote access, workload optimization, and cost optimization are top of the wish list. Demand for cloud consulting and support for cloud migration are also increasing. Customers will introduce new service providers if necessary to meet their needs.

- Relationships between MCS providers and their customers will change. Customers see the potential for strategic relationships with their MCS providers, but economic uncertainty will encourage them to renegotiate prices and ask for new, more favorable terms and conditions as relationships grow.

IT decision makers have had to deal not only with an immediate need to shift to remote work and operations, but also a need for increased security as new weak points and threats emerge. Workload optimization has become a priority as businesses adjust to quickly changing market conditions, and of course, cost efficiency is a priority in an economic slowdown and recessionary environment. Close to a quarter (24%) of companies in Western Europe have sought after-cloud-migration support from third-party providers to help them adjust operations in this new reality. Many MCS providers believe that market turmoil, such as the current pandemic and the business lockdown, increases interest in a more flexible and scalable IT platform — a great opportunity for MCS providers.

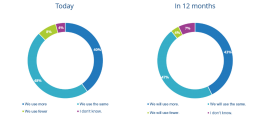

We have seen greater use of managed cloud services among European customers, with 4 in 10 companies increasing their use of MCS. Within a year, 43% will continue to do so.

What impact has COVID-19 had on your company’s use of managed cloud services? How it will change in the next 12 months?

More than a third of IT buyers will expand the number of services they use, with the strongest demand for multicloud management, next-gen security, data platforms, and cognitive capabilities. There will also continue to be strong demand for cost-optimization services. To find new services, European companies will look to change the number of providers they work with, with 45% of organizations saying they will increase their number of MCS providers. Providers need to be prepared for fierce competition as their customers work with a wide range of MCS providers from different backgrounds — from traditional technology vendors such as IBM and Fujitsu, to consulting companies such as Accenture, to telecommunication operators such as Orange and T-Mobile, and to specialized managed cloud service providers such as Nordcloud and Cloudreach.

Recommendations for managed cloud service providers

In this hyper-competitive environment, MCS providers should stay close to their current and potential clients and be ready not only to offer a broader, more comprehensive service portfolio, but also to be flexible as customers seek to renegotiate prices (25% of all respondents) and contract conditions (20%), and try to work more directly with cloud providers/hyperscalers (19%).

When deciding whether or not to work directly with a hyperscaler or one of their MCS provider partners, there are a few attributes that give managed cloud service providers the edge:

- The ability to build a long-term relationship with a client

- A willingness to engage in day-to-day problem resolution

- Being readily available to customers

These advantages must be part of the core value proposition — and are key for future business development.

At the end of June, our buyer sentiment survey showed that 80% of European companies plan to sustain or increase their spending on managed services in 2020. The opportunity is there — you just have to grab it.