Fragmented markets are characterised by:

- Low barriers of entry

- Often low product innovation

- Need for customisation

- No economies of scale

The European SD-WAN infrastructure market provides innovations. However, not everyone can enter the market easily, and though there is a degree of customisation, the technology is quickly evolving to standardise and achieve economies of scale. The SD-WAN infrastructure market should not be fragmented (Figure 1).

What Milk Choices Tell us About the European SD-WAN Infrastructure Competitive Landscape

Monday: 5:26 AM: the alarm clock goes off. Half-awake, I walk to the kitchen where I left my sports clothes the night before to avoid waking up the rest of the family. I open the fridge and… hang on, there are two unopened bottles of milk, from different brands. Do I panic? Do I prefer brand A to brand B? Oh no, it is so early to make such an important decision!

Not really, I pick a random one, get ready and ride my bike to start my 6AM hard core circuit training aimed at recovering my long lost six pack (or a least hide the one pack I built during the many lockdowns).

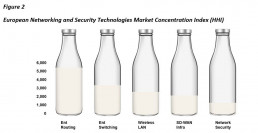

The milk industry is a perfect example of a fragmented market; no single brand owns the market in its entirety, there is abundant choice and though cows would disagree with me, little differentiation.

Like the milk industry (but perhaps more moderately), SD-WAN infrastructure remains one of the most fragmented networking technology markets in Europe (Figure 2)

Note: The Herfindahl-Hirschman Index (HHI) is a common measure of market concentration and is used to determine market competitiveness. A market below 2000 is fragmented.

The SD-WAN Infrastructure Market Should Not Be Fragmented

Besides Cisco, SD-WAN infrastructure providers have limited market shares below 12%, and are undoubtedly customising solutions suited for specific customer needs, reducing in this way the scope for economies of scale. The implications are clear — newcomers into this market can experiment and innovate, and don’t need to fight for market share gains against large competitors, but also the market is experiencing healthy growth (CAGR of 17.4% 2020-2025).

Clearly SD-WAN infrastructure is not a commodity, and though the technology has been around for a while, it provides well documented innovation. The pandemic has triggered an acceleration of demand, with lower costs and WAN security quoted as the most important reasons for its adoption as more of us adopt hybrid work (Figure 3).

Certainly, there are some barriers to entry, including investment in software design and distribution, expensive infrastructure POPs to supply services, and a significant need for partnerships to reach end customers and create brand awareness and reputation; after all, SD-WAN infrastructure carries a significant amount of sensitive traffic.

When it comes to customization, the story could be seen a bit differently. Although standardization is key, there is a need for individual industry requirements for specific features for telecom operators and managed service providers.

There is also a degree of economies of scale as new generation SD-WAN infrastructure has a significant portion of software often delivered though the cloud.

Market Fragmentation is Good for Customers

Fragmentation can increase competition, innovation, and customization of products and solutions, which is great for customers. It can, however, be a challenge for vendors that are not able to focus on profitable market fragments.

Differentiation is Key to Win Share

The key factor that helps with competitiveness in fragmented markets is Differentiation.

SD-WAN vendors look beyond connectivity experience and cost optimization to differentiate in areas such as simplified deployment, integration between network and network security operations, zero-trust network access, multicloud access, flexible network traffic visibility, and a vision for the self-healing WAN to name a few.

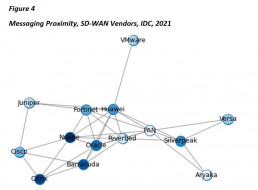

But are vendors differentiating with their SD-WAN messaging?

Using natural language processing (NLP) we can now measure messaging proximity between SD-WAN vendors; in other words, how similar their SD-WAN solution sounds when customers read their websites or watch their YouTube videos. Figure 4 shows that most vendors are bundled very close to each other — they sound the same when promoting their solutions. Only 3 vendors escape, and they are from the non-traditional (networking/security) vendor scene.

I am not suggesting that the SD-WAN market is the same as the bottled milk market, but to some extent it is behaving like it when it should not. For that reason, we believe that there will be increased merger and/or acquisition activity in periods to come. This will allow customers to benefit from a well-balanced degree of scale and customization while avoiding the messaging noise from mooltiple players in a cowded market.

To learn more about our upcoming research, please head over to https://www.idc.com/eu and drop your details in the form on the top right.