Commercial Property Risk: An Eye-Watering Market

Hurricanes, earthquakes, storms, tornados, fires, civil unrest, political conflicts and pandemics are just a few of the challenges that organisations need to tackle. Leaders need to acknowledge the existential threat of climate change and the effect it could have on their people and business operations: a warming planet creates a wide range of risks for businesses, from disrupted supply chains (e.g., scarcity/cost of resources) to operational impact (e.g., facilities damage and workforce disruption) and the realisation that environmental sustainability efforts are becoming the core tenets of companies’ culture and brand identity.

We live in a world where the devastating impact of climate change is the only certainty. Planning well ahead for insurance coverage, however, does not appear to be top of mind for many organisations. Globally, the impact of natural disasters cost the economy $280 billion in 2021. Reinsurer Munich Re says around $120 billion of this was covered by re/insurance protection, leaving governments and NGOs to shoulder the remainder.

Getting insurance coverage — probably the easiest option for organisations in the short run, at least looking at the financial repercussions of commercial real-estate risks — isn’t the best option owing to the intrinsic complexity of commercial underwriting practices. Exposures are heterogeneous, intermediated and often based on qualitative assessments. In addition, risk outcomes are not binary, and policy wording and exclusions may seem straightforward until they are challenged by litigation and subject to interpretation. Because of this, the commercial property segment has a significant protection gap that is pushing insurance leaders to scout for technological opportunities that might offer them some support.

With the introduction of low-cost cloud computing, faster data processing and advances in artificial intelligence for data extraction and image analysis, it’s now possible to accurately develop digital models of risk at commercial properties without even having to visit them. These digital replicas provide a simulation and experimental environment where organisations can conduct what-if scenario analyses and goal-seeking hypotheses testing that enable them to minimise the loss frequency and severity of exposure to such natural catastrophes.

How can insurers facilitate the adoption of digital twin technology by embedding it in their business models? What are the most innovative digital-twin-enabled service offerings?

Digital Twin Framework for Insurance: The Rising Evidence-Based Culture

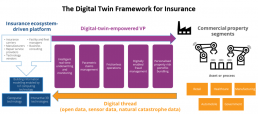

Insurers are embracing digital twin frameworks to make sense of data from the ecosystem of architecture and engineering companies, construction and real estate, critical infrastructure companies and governments.

Let’s now look a little closer at the digital-twin-enabled service value propositions.

- Intelligent real-time underwriting and monitoring

Digital twins’ main application in the commercial property line of business is to improve the accuracy of portfolio data, enabling insurers to carry out risk-weighted underwriting and ratemaking practices, reducing losses and creating for the first time the chance to offer risk prediction and prevention services by continuously monitoring risk exposure and external dynamics.

- Parametric claims management

Digital twins can deliver real value in the underwriting of parametric insurance products. By applying AI and satellite image analysis across a commercial property portfolio, insurers can identify potential sudden events that might represent losses and automatically verify whether that loss is covered by the insurance policy contract — and potentially execute the claim settlement with straight-through-processing methods.

- Frictionless operations

When citing frictionless operations, I’m referencing the wide application of digital twins and all the information they help to track as a pull for process mining — exploring processes’ real workflows and performances, identifying loops, redundancies, duplications and bottlenecks, and potentially optimising those processes.

- Digitally enabled fraud management

Once a claim has been reported, digital twins can draw on the continuous inward streaming of IoT data to enable insurers to replicate the environment in which the damage occurred and assess whether the claim is fraudulent.

- Personalised property risk portfolio bundling

Another service proposition made possible by the adoption of digital twin technology is the ability to better adapt insurance coverage plans based on real, monitored usage. Ultimately, this is about creating overall insurance coverage offerings that are personalised to the needs of the insured, improving customer experience and satisfaction.

Revolution in the Insurance Industry

Insurers need to use technology to drive a smarter underwriting and risk management approach. There’s no easy way to do this and there are some key questions they need to address, such as do you have the necessary data to start this journey? How can digital twins transform your specific business model? How will you engage in a wider system of digital-twin-driven partners?

Our research shows that embracing the use of digital twin data alongside IoT and AI will help to drive improved underwriting performance and support customers’ risk management practices.

To learn more about digital twins or to ask any insurance-related questions, please contact Davide Palanza or head over to https://www.idc.com/eu and drop your details in the form.

Further reading:

The Digital Twin Opportunity for the Insurance Commercial Property Space. This IDC presentation walks the reader through a conversation journey that starts by tackling why commercial property is ripe for modernisation and why such a technological trend should be on the radar of commercial insurers, reinsurers and brokers. It also defines digital twins, examines their components and determines the value they can bring to the insurance industry.