Q3 marks a turning point for companies as they consider a budget-constrained future in a cash-strapped world

At IDC Cloud Pulse, a quarterly survey that takes in views from up to 1,700 cloud consumers, we have been tracking how companies are being impacted by, and how they are responding to, macroeconomic trends. We then consider how this relates to the consumption of cloud. Questions around Inflation and Energy Costs were added to our survey first in Q1, 2022. The Possibility of a Recession was new in Q3. And we will now be adding Recession into future surveys.

These new additions tell a story about the challenges businesses have had to endure over this last year. Not as much, however, as the responses we received when we asked about the likely impacts to businesses.

Each quarter companies are asked what events are most likely to cause disruption to their business over the course of the year. They can respond using a sliding scale of 0-10 with 10 being the highest amount of disruption. The above results show only those responses between 8-10 (what we would consider as ‘high impact’).

During Q1 and Q2, not too many more than a third of companies said they felt they were experiencing major impacts from the macroeconomic trends we asked about. In Q3, this rose to around a half. Inflationary costs were seen across more of the business, energy price rises became a reality, and national and global recessions became less likely to avoid. At the same time, markets still battled ongoing supply chain challenges, in part brought on by continued to reactions to the COVID pandemic. Many of these impacts are intertwined, making the current macroeconomic landscape even more difficult for companies to navigate.

Budgetary Impacts

During Q3, for the first time, we saw companies shift towards a more pessimistic view of the business environment. Early indications from our Q4 data suggest we will see even higher rates of pessimism moving forward.

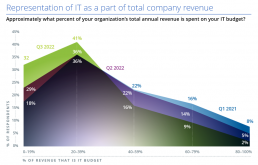

This pessimism impacts budgets. Cloud makes up around 31% of IT budgets – this is up only slightly from around 30% seen in Q4, 2021 despite previous years showing higher annual rates of growth in terms of cloud as part of IT budgets. The real challenge is, however, that IT budgets are decreasing when viewed as a proportion of overall company revenue. As we know, company revenue is also being challenged (and where it isn’t, margins are suffering from increased costs).

If we focus on the area of inflation – where we see some of the earliest impacts on industry in terms of economic stress – we gain valuable insight into why we are seeing budgetary constraints across IT. Companies operating or consuming a cloud environment first felt inflationary pressure in the form of increased professional services costs, and then application software subscriptions. These are two areas where companies are more likley to operate with rolling monthly contracts.

During Q3, we started to see more companies (25%) saying they could now see increases across private cloud infrastructure (most likely brought about as a result of increased equipment and energy costs). Internal skills costs were also a major challenge.

Public Cloud as a Response

Responding to these challenges, a quarter of respondents said they will be looking to migrate more of their environments to public cloud/ Software-as-a-Service. Around the same amount again (23%) said they will be looking to find reductions for spend across their cloud estates.

With almost a fifth (18%) of respondents saying they are still waiting to assess the impact of inflationary pressures, these figures could grow.

Cloud Pulse findings also show that the number of companies that say they are ‘Public Cloud First’ when it comes to their cloud adoption strategy is more (32%) when companies say they are directly impacted by inflation compared to just 21% for those that are not.

Note, the rate of Public Cloud First companies has been decreasing annually. Q3 marks an increase overall in the number of companies relying on Public Cloud before taking a hybrid approach – though hybrid remains the number-one approach to adoption).

Qualities that Count

Another shift is in the qualities companies are now requiring of their cloud providers. In Q3, 2020, the most important Company Attribute sought by cloud consumers was a global/international footprint. What companies now seek are providers they can label ‘trustworthy’.

In this case, Trustworthy relates to a provider’s ability to be reliable and responsive, to meet contractual requirements, to be transparent about pricing and to keep promises made to the business (we did ask). During this time of macroeconomic uncertainty, customers also want to work with technical experts that can deliver services at speed with guarantees along the supply chain.

We also see shifts in what companies require in terms of cost and pricing. In 2020, the focus was on flexible payment terms and enterprise-wide agreements. Now it is more about flexbile licencing and credits that allow companies to move their applications and workloads across cloud and even non-cloud environments as they require.

Many companies know their business could have to alter the way they consume and gain access to IT over the coming year. Where rising costs – from inflation or energy increases – are already felt the requirement for flexibility gives way to predictable pricing, with many IT departments focussing more on cost optimization and forecasting.

Many cloud vendors have already started to notice these shifts across their own businesses, from customer conversations they are now having to the budgtary bottom line. Those who will succeed will be those that can quickly pivot and reinvent solutions – in particular with the right financial models.

Companies want to continue to benefit from cloud as they navigate uncertain times but companies will be more selective about what they are deploying and how over the coming year. Many will be taking stock on current digital transformation agendas and application portfolios to create leaner, more efficient, IT responses to current business needs.

For more on these key cloud trends, including how individual providers aligned to current market sentiments and needs, ask further about IDC’s Cloud Pulse data. Cloud Pulse’s rich insights cover a range of cloud topics from deploynents to application landscapes, vendor selection, ROI and more.