Sustainable finance was one of the hot topics of 2020 (besides you-know-what), generating so much interest that regulation has been quick to follow, at least in the UK and the EU.

Judging the Book by its Cover: The Banks You Are Doing Business With

There is a Spanish proverb, “Dime con quien andas y te diré quien eres,” that is often quoted to assess someone’s qualities or credentials by simply observing the friends they are surrounded by. At school, my friends were often regarded as nerds… yep, no offence taken.

In English, a similar proverb would be “Birds of a feather flock together” or “You can tell everything about a person by who their friends are”.

When it comes to sourcing our debt or choosing our banking friends, we pay little attention to how the lender obtained the funds we’re using to mortgage our houses or to the credit given for that long-promised holiday. So, people that don’t know us can’t really tell if we’re good or bad by the friends we chose to do business with.

The same goes for business: little thought is given to what is behind the veil of regulatory compliance and corporate environmental, social and governance (ESG) reporting. It’s often brushed off with a shrug and a comment along the lines of “money is money”. But really, where do these funds come from? As long they’re widely available, the vast majority of companies turn a blind eye to how the funds are sourced.

This Is About to Change: Banks Unite in the Race to Net Zero

On April 21, 2021, a new industry-led and UN-Convened Net-Zero Banking Alliance was launched.

Labelled The Glasgow Financial Alliance for Net Zero (GFANZ) and chaired by Mark Carney, the UK Prime Minister’s Finance Advisor for COP26 and UN Special Envoy for Climate Action and Finance, it unites over 160 firms across the financial system to accelerate the transition to net-zero emissions by 2050 at the latest.

Banks have the dual task of at least doubling their investment in financing current and new green technologies while reducing or transitioning their exposure to existing climate change contributing investments.

Banks are an essential ingredient from which organisations can source funding to:

1. Scale new green proven technologies

2. Invest in new research on better and cleaner technology

GFANZ members must be accredited by the UN Race to Zero campaign. They must use science-based guidelines to reach net-zero emissions, cover all emission scopes, include 2030 interim target setting, and commit to transparent reporting and accounting in line with the UN Race to Zero criteria.

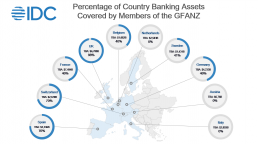

Room for Improvement: Percentage of Country Banking Assets Covered by GFANZ Members

The organisation has recruited just over 50% of European banks when measured on asset contribution, but the story differs by country (see the figure below). Nearly every major bank headquartered in the UK has become a member, but at the other extreme, not a single Italian or Dutch bank has committed to it.

GFANZ has the difficult task of persuading prospects, onboarding new members and working with them to deviate or transition their funding portfolios from the current path. The way it stands now, there is an increased risk and exposure for organisations that are not committed to their own countries’ net-zero strategies.

What Does This Mean for Technology Providers?

For technology providers the move is extremely important as it outlines banks’ role in the circular economy as sources of funding, debt and investment. It also places an emphasis on their role within the entire supply chain.

IT providers need to consider sourcing debt and investing profits from net-zero-committed and accredited financial institutions, as our research shows that over 62% of European enterprises incorporate sustainability objectives (see IDC EMEA Services Survey, 2020), including green financing, in their RFPs when choosing IT partners. Vendors should also assess the reputational risk that further business with non-net-zero-committed institutions could present.

Allowing for transparency of how IT providers finance their debt but also how green their own financial offerings are may prove to be a significant differentiator when bidding for new IT contracts or renewing existing ones.

IT providers are also well positioned to facilitate technology solutions for the finance sector, through ESG data management capabilities, green portfolio data comparison software or by tracking their own emissions.

For IT buyers, financing projects from transparent, accredited vendors will become increasingly important to reach their own sustainability objectives and signal their transparency to their own customers, so they can be better judged on who they do business with.

To learn more about our upcoming research, please head over to https://www.idc.com/eu and drop your details in the form on the top right.