Navigating the Storms of Disruption in the Nordics — Finding Potential Beyond the Winds of Change

From the beginning of the pandemic, IDC has talked about the new winds of change that were to come and how to navigate them in a new normal context. Now, we are right in the middle of the change, and people, businesses, and society are enduring new storms of disruption, striving to find opportunities to keep afloat and continue to deliver value.

First the pandemic, and then the Russia-Ukraine war, have created a critical turning point for Europe and the entire world, impacting the functioning and evolution of global ICT markets, from tech demand and supply chain limitations to inflationary pressure, significantly increased costs of energy, skills availability, and increased cyberattacks. And Nordic countries have not been spared from the consequences of this situation, with the changing macroeconomic conditions resulting in a shift of business priorities. Customer satisfaction has remained ttop priority throughout the year, but cost savings have become relatively more important at the expense of profits.

According to the latest IDC Future Enterprise & Resiliency Spending Survey (FERS) from December 2022, more than half of Nordic companies find that rising IT costs have the greatest or second greatest impact on ICT spending plans. This is followed by challenges related to the IT supply chain and expectations of a coming recession.

IT investment plans are directly affected. When prices increase, companies need to either increase spending or reduce the amount purchased — e.g., buying fewer units, licenses, or consulting hours. While few markets are unilaterally impacted, the technologies and projects that have the strongest and most immediate impact on business performance fare better than the ones that can relatively easily be postponed.

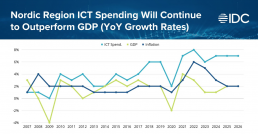

Despite the gloomy expectations, IT spending in the Nordic region, including Denmark, Finland, Norway, and Sweden, is expected to outperform GDP performance, as shown in IDC’s Black Book Live Edition from December 2022. However, with inflation expected to be around 5% in 2023, real growth will be limited.

Where Will Nordics Companies Expand Their Investments, Despite the Headwinds?

To maintain performance and mitigate the impact of the geopolitical and macroeconomic situation, Nordic companies will accelerate investments in technologies aiming to support them in their digital transformation.

Thus, the following key areas are identified by IDC to drive spending among Nordic organizations:

Cloud

Companies will keep their budgetary plans related to cloud infrastructure (IaaS) services. Overall cloud spending in the Nordics is estimated to achieve 22% five-year CAGR, reaching more than $27 billion by 2026. Even though more established than other emerging technologies, cloud will continue to drive investments across companies aiming to become digitally ready and to accelerate their business performance.

Internet of Things

According to the latest IDC European Emerging Technologies Survey from 2022, more than 40% of Nordic companies are already using IoT solutions. IoT is seen as part of the solution for the energy crisis, being critical to reduce costs, optimize processes, and improve performance. IoT spending will remain steady in Nordics, especially on use cases related to smart grids, electric vehicle charging, advanced payments, and so on.

Security

Investing in cybersecurity technologies is among the top 3 priorities for organizations in the next two years. Investment can be perceived as a cost center, but it also enables new offerings and reassures existing and potential customers. Cybersecurity spending in the Nordics is estimated to grow at 9% 5-year CAGR, reaching more than $6 billion by 2026.

Artificial Intelligence

Artificial intelligence is one of the fastest growing technologies due to tremendous potential to improve customer experience, enable new employee experiences, mitigate skills shortages, and transform the workplace environment. According to the latest IDC European Emerging Technologies Survey from 2022, more than 40% of Nordic companies are planning to adopt artificial intelligence solutions in the next two years.

Enterprise infrastructure, managed services, project/professional services, and anything “as a service” are additional areas where Nordic organizations indicated they will continue the pace of their investments.

How to Capture the Pockets of Growth in the Nordics Region

Many companies are struggling to find the right skills or partners to work with during the digital transformation journey, especially in such uncertain times. Offering guidance and support with the right technology stack, customized to address different industry-specific challenges will be the winning bet in these times.

To address all the challenges Nordic companies are facing, IT vendors must plan their strategy with precision. Adjusting to industry changes and rapid demand fluctuation, being use-case centric, and placing the right “growth” bets will be crucial to resist storms and headwinds.

IDC will help technology vendors remain resilient, stay competitive, and win revenue despite turbulent times by supporting their precision planning with the following assets:

- Assess your competition and your position by analyzing technology markets, vendor shares, and forecasts — IDC Trackers

- Position your products and services to the appropriate audience with an extensive market overview — IDC Black Book

- Find strategic opportunities by industry, company size, use case, and geography — IDC Spending Guide

Contact us for more information about how IDC Data products help business leaders target, plan, and execute their most important strategic initiatives, analyzing more than 100 countries, 120+ technology markets, 20 industries, and more than 400 use cases.