5G does not currently look as if it will produce more big new players in China, as it favours large companies with extensive R&D. Instead, it offers the opportunity for the Chinese brands that gained scale in 4G to push their global expansion further, in particular into Europe.

All introductions of a new technology are potential disruptions. 4G was a disruption that enabled a new group of Chinese brands to push others out of their domestic market and become the big new players in the global smartphone arena.

These brands have already made a lot of progress abroad. Xiaomi and the BBK stable brands — OPPO, vivo and OnePlus — have expanded across Southeast Asia and other emerging markets such as India.

Now would seem a great opportunity for those brands in Europe. Their state-backed Chinese rival Huawei, already strong in Europe, is a weaker company given the US sanctions, and there is market share at play.

The average 5G sales prices in China of the new brands are already down to half of those of the 5G models of Samsung that dominate 5G sales outside China.

Europe, a Quarter of Global Premium Android

The new Chinese players aspire to be full portfolio players producing premium as well as budget models. Europe has to be a key element in any such strategy — it accounted for nearly a quarter of global Android sales above $600 retail before sales tax in 2019, according to IDC’s Worldwide Quarterly Mobile Phone Tracker.

This is the quandary for the Chinese brands. While the market opportunity is to push 5G smartphones at entry-level prices for the technology, if they come into the market at too cheap a price they will just cement the view that they are cheap Chinese alternatives.

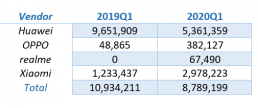

Unit Shipments New Chinese Brands in Europe*

Brand Recognition Does Not Come Overnight

Building a brand takes time. An alternative approach would be to buy up an ailing Western brand and relaunch it. In cars, to take one example, China’s Geely has done that successfully with Volvo.

In phones, Lenovo has done less well with the Motorola brand, and TCL with the Alcatel brand, but the new Chinese players come from a much stronger position within their domestic market. The trouble is these days there are just not obvious Western brand name candidates left to take over or rejuvenate.

Instead there have been a raft of subbrands. BBK’s vivo recently spawned IQOO, and Xiaomi has launched Pocophone. Launching a subbrand may be a way of making a part of your portfolio more exclusive, but it’s only likely to work once the main one is well known. These Chinese names are not so high profile yet in Europe.

On the brand image score, it would make sense to enter at the top of the market and then only come down in 5G pricing step by step. On the other hand, the 5G opportunity in Europe is in the middle, and it is now.

OPPO appears to be trying to play both the top and the middle at the same time. At the end of May, it launched two cheaper additions to its Find X2 5G range in Europe. It has chosen to mimic the formula that has worked well for Huawei, in having a “Lite” version of a flagship phone.

But the price gap is massive — £399 for the Find X2 Lite against £1,099 for the flagship. This may be stretching the halo effect a bit too far. Nor can the Find X2 name be considered a real winner.

The Importance of the Operator

But OPPO has made one big move in playing the game in Europe, where the business of selling phones is largely through the mobile operators and their retail networks. Earlier in May, it announced a deal with Vodafone to put its phones into the operator’s shops across the continent.

Working with operators came easily for Huawei, as the operators were already its clients in infrastructure, but the newer players have generally built up an export business in countries where the open market dominates in phone retail. Xiaomi goes further, liking its own brand name shops where it can display all its other products, which extend to scooters and luggage.

OPPO says that under its deal with Vodafone the promotion of the Find X2 range will be linked with tariff deals that will give buyers 5G use at no more cost than 4G.

Overcoming the Indifference Threshold

That’s the sort of arrangement that will help 5G get over the threshold of “do I really need it” and “what does it really offer me more than I’ve got at the moment”, which is the big bar to 5G becoming mass market, particularly in economies reeling from coronavirus lockdowns.

Europe is an old continent, and conservative. If you want to succeed in Europe, become more European.