The Impact of COVID-19 on IT Markets in Europe

The Covid-19 pandemic is having a profound impact on the global economy, and IDC has devoted many resources to understanding and forecasting its impact on IT markets now and for the future and advising companies on how they should respond.

Why your COVID-19 response will define your reputation for the next decade

IDC analyses the rapidly evolving economic forecasts and works with our European CIO and digital executive advisory boards to understand the drivers around technology spend in Europe, alongside regular Europe-wide surveys of IT buyer sentiment. Most European organizations expect a revenue decrease in 2020, of course. This is bringing a sharp focus on ROI from digital investments. 70% of the organizations surveyed in our most recent survey (closed March 26, 2020) reported that technology-led transformation projects are being revised to drive efficiency and ROI. The impact is threefold:

- Re-evaluation of investment to assess the possibility of achieving greater efficiencies while reducing costs.

- Leveraging existing internal resources and technology investments to cut unnecessary costs – and focusing monetary resources on more critical areas.

- Maintaining only those projects the deliver a significant and consistent ROI or projects that secure short-term business continuity. Examples include infrastructure provisioning projects and security to allow remote working, connectivity and collaboration.

The current IT markets situation

Therefore, IDC expects strong downward pressure and indeed negative growth in spending on IT services, software and hardware, not just in 2020, but at least through 2022.

- Services. The IT services market will be strongly impacted in 2020 and beyond. Project services and business process outsourcing (BPO) will be hit hardest, significantly more than managed and recurring services.

- Software. We have seen some strong growth in software usage, while other categories have been negatively impacted. A block on developments without short-term ROI will restrict spending on traditional on-premises applications software with heavy investments in resources and complex deployments. But online collaboration and cloud IaaS and PaaS solutions are mission critical right now to allow greater flexibility. Anything that helps with business resilience – such as automation (e.g., RPA) and financial planning and forecasting – will be seen, post-pandemic, as crucial to recovery and ongoing operations. There will be sustained demand for collaboration tools and platforms for remote working, distance learning, telemedicine, collaborative design, and so forth.

- Security and maintaining SLAs are of heightened importance (see Cybersecurity Challenges in the Time of the New Coronavirus). With increasing numbers of remote workers constantly connected through collaboration tools, the risk of services outages is exponentially increased and network investments on VPNs and others will rise.

- Hardware. The IT hardware market has been highly impacted, especially for those products requiring parts coming from China, given the disruption of the supply chains. IDC expects to see continued inventory shortage for servers and storage devices. For instance, the ODM market shifted from a situation of oversupply to a shortage crisis, highlighting the complexities of the global supply chain. (For more on this, check out the IDC podcast “Episode 54 – Coronavirus Impact in Europe’s IT Market“).

Three key action vectors

For suppliers, your COVID-19 response will define your reputation and underpin your success for the next decade. The pandemic is accelerating the redefinition of business values. Technology vendors should:

- Emphasize financial value to bring a sharp focus on ROI. Help customers to understand financial and business outcomes that an ongoing or a brand-new project can deliver.

- Create ecosystem value to accommodate new value chains. Highlight how technology can help to connect the entire value chain, extending the infrastructure with other organizations to continuously deliver optimization across the entire value chain.

- Focus on Societal Value to promptly respond with #Coronakindness measures. Understand and act on crisis management capabilities and provide free or freemium solutions to the market to generate customer loyalty for the long term. Helping customers, employees, and society as a whole will shape new internal processes and increase employees’ engagement, employee and customer loyalty, and brand awareness.

To learn more, please contact Philip Carnelley and Erica Spinoni or drop your details in the form on the top right.

How Blockchain Can Help in the COVID-19 Crisis and Recovery

The COVID-19 pandemic has impacted virtually all businesses, but the effect has not been uniform (watch our webcast on the impact of COVID-19 on the European technology market). While the current disruption may present challenges to the blockchain industry in the short term, it will also unlock new opportunities in the mid and longer-term. By providing help in the COVID-19 crisis and recovery, blockchain can play a pivotal role in accelerating post-crisis digital transformation initiatives and solving those problems highlighted in the current system.

The pandemic and the subsequent lockdown have had a negative impact on many industries and we expect a significant slowdown in technology spending, including blockchain. Before the pandemic, IDC’s Worldwide Blockchain Spending Guide had forecast European blockchain spending of $1.4 billion for 2020 and healthy growth of 58% CAGR to 2023. IDC now expects a number of changes in spending in 2020. Blockchain solutions will see a slight slowdown, with spending decreasing by around 8% in 2020 compared to the previous forecast.

Nevertheless, there are some bright spots where blockchain is used to combat the effects of COVID-19 and aid in the recovery process. These innovative use cases can demonstrate the benefits of blockchain to a wider audience.

Supply Chain Management

The COVID-19 crisis has caused major disruptions across global supply chains. Two factors in tandem play a very pernicious role: many factories have shut down due to safety concerns and there is unprecedented demand for certain goods, especially medical supplies. This high demand forces many users to source supplies without knowing their origin or quality. Long supply chains cause needless opacity and this makes it difficult to forecast and plan supply accordingly. Blockchain is particularly suited to supply chains because it can connect all stakeholders in a supply chain and provide a single source of truth. It provides transparency and breaks down data silos while guaranteeing security. This is why many of the blockchain solutions deployed in the wake of the COVID-19 pandemic are in supply chain management.

- Blockchain solution provider TYMLEZ volunteered its services to the Dutch government and will deploy a blockchain-based solution that matches supply and demand in the medical products ecosystem.

- The mobile and online payment platform Alipay has created a blockchain-based solution that helps charitable organizations collaborate more efficiently and transparently. One of the features is to track donations of relief supplies and help allocate them more efficiently.

Contact Tracing

In these difficult times, the right balance has to be struck between data gathering and protection of privacy. Blockchain can be used to both gather and collate patient data more efficiently, monitor patients’ movements to guarantee social distance, and protect their identity at the same time. In blockchain there is no central authority and users are given control of their personal data. They can selectively share information that is important for coronavirus mitigation efforts, while protecting their identity and other sensitive information.

- A team of privacy experts across Europe have proposed a blockchain-based system for COVID-19 contact tracing using Bluetooth. The solution will use decentralized privacy-preserving proximity tracing (DP-PPT), a protocol designed by a number of research institutions in Europe, to ensure user privacy and avoid data misuse.

- German tech scale-up MYNXG has created a blockchain-based solution that enables mobile phone tracking while guaranteeing user privacy. Governments and healthcare organizations can gain useful information through coronavirus tracking, while users can be assured that their personal information will not be shared.

- Genobank, the decentralized biobank for storage of biodata, is building an app using the Telos blockchain platform that enables people to acquire anonymous coronavirus tests and send that information to relevant organizations.

Disaster Relief and Insurance

The enforced lockdown introduced by governments around the world has exacted a heavy toll on many businesses. Most physical stores have closed, while demand for all but the most essential items has plummeted. In these times of financial distress, governments have taken measures to stave off a steep economic downturn. Providing loans and other financial lifelines is a way to keep many businesses afloat. Blockchain is used in the loan and insurance industry to simplify and shorten the complicated application and approval process by removing third-party intermediaries and inherent delays in processing. The benefits include faster processing time, lower costs, reduced operational risks, and rapid settlement for all parties involved.

- Since the end of January China has distributed loans amounting to more than $200 million to 87 businesses using a cross-border, pilot blockchain finance platform. Henry Ma, CIO at online lender WeBank, said, “The cross-border, financial blockchain services platform can play a bigger role, and help medium and small enterprises improve the efficiency and convenience of getting export trade financing and other financial credit support.”

- The mutual aid blockchain platform Xiang Hu Bao is making payments to members infected with the coronavirus. Document processing and payouts are made quicker and all parties can observe the entire process.

Missed Opportunity?

Politics, especially elections and voting, have also been disrupted by the pandemic. The traditional political process puts politicians, voters, and all those involved in the related services at risk. The recent Wisconsin Democratic primary in the U.S. could have been avoided by using a secure blockchain voting mobile app, though while the proof of concept is there, no dominant solution from a prominent company has emerged from the many tests and pilots.

Smaller countries have made more rapid progress. Estonia remains the go-to example for electronic voting in Europe, but even this system has been criticized for its identity authentication method. Larger countries such as Germany, Finland, Ireland, and the Netherlands have run trials but have subsequently abandoned them. Blockchain technology can alleviate many of the security concerns that have plagued previous e-voting attempts. However, the biggest hurdle remains the general public’s skepticism and mistrust of voting using digital technology.

In Conclusion

IDC believes blockchain technologies offer great potential in many COVID-impacted scenarios, especially in the supply chain. Due to the pause in investments and the prioritization of urgent expenses, however, blockchain will be forced into a temporary slowdown. Given its benefits in terms of reliability of the supply chain, transparency across multiple use cases, and the tracking of goods, however, blockchain investments are expected to recover once the pandemic eases. The recovery will be bolstered by the European blockchain ecosystem, with the biggest players in the market working together with a variety of smaller, innovative companies.

Opportunities for Technology Leaders in a Coronavirus Recession

In a previous blog I reflected on the IMF’s expectation of a rapid shrinking of the worldwide economy and what CIOs (along with everyone else) need to do right now in order to be ready for the challenges ahead.

For the CIO and those in the technology team, this is a moment of great opportunity as well as a challenge. Whilst we would not have chosen the method, it is fair to say that many sacred cows around processes involving people being physically present have been slaughtered without a second thought in the name of survival though the COVID-19 crisis. To use another metaphor – the Digital Transformation Genie is well and truly out of the bottle, and it’s not going back in.

We have seen lots of evidence through the rapid shift to home working and the way organisations have coped with the change to working at distance, that those who have invested in digital transformation programmes in recent years have been very grateful for those tools that allow them to manage, collaborate and create value through digitised processes and reduce the shock to their systems from the pandemic restrictions. So, it stands to reason that investors and boards will be expecting more from their technology teams as they enter a period of slowdown where the issue for most organisations will be how to ensure they can continue to trade, retain as many staff as possible and be ready for growth when the recovery comes.

What this looks like for your team depends a great deal on your current business model and how exposed you are to the most affected markets as the recession begins. For example, we’ve seen exceptional efforts by retailers who have previously not worked to a delivery or e-commerce model, to pivot and change stores into warehouses, deliver software and tools in very short periods of time. Rapid changes to key customer interaction channels have been essential for those who operate traditional call centres which will remain closed or run at reduced capacity for many months to come. Healthcare providers have deployed video consultation processes, consultancies have built virtual job fairs, manufacturers have leveraged their additive manufacturing capabilities to provide PPE to meet local needs.

The CIO has been at the forefront of these efforts and of existing moves to integrate processes with customers and supply chain, building agile capabilities that utilise on-premise hardware where appropriate and scalable cloud tools where they fit best. We should expect that companies looking at shrinking markets will need ways of mothballing certain products or services, or delivering in a different way and focusing on how they add value to the process as a whole. I’d also expect the CEO and CFO to be demanding rapid, high-quality data about the performance of their business so that they are not faced with unexpected bad news or having to make time-pressured decisions without knowing the full picture.

Responding to these demands with cash constraints is not easy but it’s fair to say the CIO community has had a lot of practice over the years! Staying aware of your opportunities and potential for wins can be tough when the overall trend is down, so keeping in touch with your networks and advisors for that chance to take a step back and see what is happening around you will be really important.

Whilst a recession is tough for everyone, there’s no reason to think that technology teams with forward-thinking and practical leadership shouldn’t be the go-to people to give organisations the very best chance of success and survival, with all the rewards that go with that in the longer term.

Reimagining Mobility in Cities and Beyond

Are we heading toward a world where mobility in cities is convenient, affordable, safe, and environmentally sustainable? Or congested, expensive, risky, and polluting?

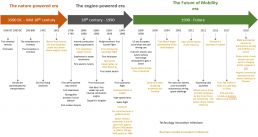

Mobility has been on a steady growth path for many years. Technology innovation transformed mobility between the 18th and early 20th century. With the second industrial revolution, moving people and goods around became more efficient. More people could afford to move, but the engine of moving around has not changed.

That is literally because the combustion engine has dominated transportation. The growth in private vehicle ownership and collective transportation services operated by large monopolies or oligopolies (such as airlines, railways, and public transit) is still the primary business model.

But the negative aspects of this mobility model (pollution, congestion, traffic fatalities) are hindering social and economic development around the world.

The challenges of mobility coincide with the development of technological advances. Electric mobility, autonomous driving, and digital services are converging with alternative business models such as ride-hailing, ride-sharing, micro-mobility, and demand-based transit to create new opportunities.

The clash of mobility challenges and innovations can turn mobility into a force of progress and happiness once again. Singapore’s transport minister, Khaw Boon Wan, speaking at the ITS 2019 opening ceremony, said:

“I look beyond the technology element. What matters is that we have a transport system that is fast, safe, reliable, and, very importantly, affordable for all people.”

Possible Future Scenarios of Mobility

The future of mobility will not be determined by a single factor. It will be the combination of societal, technological, economic, environmental, and political megatrends that will reshape how people and goods move in cities and beyond.

How these trends interplay between 2020 and 2030 will determine demand for people and goods mobility — whether it increases or diminishes, or how much individuals and organizations are free to choose when, where, and how to move.

The impact of this evolution will last for 30 years and more, just as the advent of the oil-fueled and car-based economy determined the past hundred years. The next 10 years will determine whether we will live in a world where mobility is convenient, affordable, safe, and environmentally sustainable — or one where it is congested, expensive, risky, and polluting. Four possible scenarios could unfold:

- Sustainable mobility. Sustainable mobility will result in safer roads, less pollution and congestion, and more road space given back to neighborhood living.

- Individualistic mobility. Individualistic mobility will result in lower pollution and safer roads, but also endless gridlock, so that people spend more and more time in their private vehicles.

- Utilitarian mobility. Utilitarian mobility will result in most people enjoying safer roads, and less pollution and congestion, but being subject to strict surveillance and limitations on their mobility choices.

- Elite mobility. Elite mobility will result in most people enjoying lower pollution but being forced to move less and experience endless gridlock.

Impacts Across the Mobility Ecosystem

Transportation companies, governments, vehicle OEMs, retailers, insurance companies, information and operational technology suppliers, and other organizations that will be impacted by the changes in mobility in the next 10 to 20 years must prepare now. They must understand how three main attributes of people and goods mobility will vary among different scenarios:

- Experience: including planning, payments, navigation, on the move services, and loyalty programs

- Space: including vehicles, physical infrastructure, signaling and safety systems

- Ecosystem: including policymaking, revenue models, and data sharing

Organizations across the mobility ecosystem can choose to play an active role or wait until the transformation makes them obsolete. The organizations impacted by the future of mobility that do not consider these strategic implications will not get their expected financial return on technological innovation. And they will be buying hyped products that are immature and therefore come with safety, financial, and reputational risks.

To learn more, please contact Max Claps or drop your details in the form on the top right.