Healthcare and Life Sciences: Key Trends and Digital Strategies in 2020

The convergence of new technologies and new business requirements is heralding a new type of healthcare and life science enterprise. Value-based care is changing the way the two industries look at their operations, resources, and relationships.

The focus on patient value is taking healthcare and life science organizations closer to patients, thanks to:

- Greater personalization of services and products

- Better integration along the patient journey

Pursuing personalization and integration requires organizations to embrace a new health information paradigm. Health information needs to be secure, granular, real time, and context relevant.

We call this the “Patient of One” paradigm — a 360-degree view of the patient, aimed at providing the necessary insights to improve outcomes and experiences. This will lead to an evidence-driven culture that will permeate healthcare and life sciences, and enrich and reshape the way organizations are run.

The Patient of One is also the overarching theme of our new report series on key trends for 2020 for European healthcare systems, hospitals, and life sciences and pharma. The reports investigate specific trends and market dynamics, highlighting the common strategies of healthcare and life science organizations pursuing a Patient of One vision.

A New Patient Value Led Scenario

According to IDC research, patient engagement and experience is the top business priority in 2020 for 60% of European healthcare providers and 55% of European life science organizations. Healthcare and life sciences are building new and wider ecosystems to create new services and products. To increase patient value, they are focusing on new integrated models.

This fosters the deployment of population health management initiatives. These encourage the use of real-world evidence for improved management of health needs. This need to leverage a wider range of health determinants is driving investments in new infrastructures and data hub projects. Increasingly, these infrastructures are also supporting activities such as clinical research and pharmacovigilance.

Ensuring the Right Conditions for the Workforce to Excel

To innovate, the way they interact with patients and partners, healthcare and life science organizations need to ensure that their workforce has the right conditions to excel. The “future of workforce” requires organizations to:

- Enable new skills and experiences

- Leverage human-machine collaboration

- Support a dynamic environment unrestricted by time or physical space

IDC surveys show that a quarter of European healthcare organizations are investing in AI for RPA and predictive workforce management. At the same time, 24% of European life science organizations are using AI and robotics to augment workers’ capabilities.

European hospitals are looking to make their operations more efficient, leveraging IT-OT convergence and exploring opportunities to seamlessly integrate department operations and IT architecture. Some organizations are already in the next stage of innovation, leveraging IoT for new business models and paving the way to “hospital digital twin” models.

Better Decisions Demand Better Information Management and Governance

A clear strategy for information management and governance is a key enabler to integrate internal and external data streams and turn them into decisions and actions.

Data quality and reliability depend on a strong focus on interoperability, information life-cycle management, security, and regulatory compliance. This will enable innovation to flourish, while ensuring compliance and patient safety. A coherent approach here will create a solid foundation to maximize information potential, with a good information management framework enabling organizations to:

- Expand digital platforms beyond a conventional layered architecture

- Combine and scale next-generation solutions across and outside the organization

The Future of Leadership

To guide this transformative journey, European healthcare and life science leaders need to champion an evidence-based culture. The ability to combine single process optimization and the broader goal of patient value will be a fundamental differentiator in 2020.

Most forward-looking organizations are already adopting systems that measure the alignment of their digital initiatives with business goals. IDC surveys show that 36% of European life science organizations have started using new metrics to assess the impact of digital investments on the creation of customer value across the value chain.

WiFi 6: How to Compete in Europe

WiFi 6, or 802.11ax, is the latest WiFi connectivity standard developed by the Institute of Electrical and Electronics Engineers (IEEE). IDC predicts that WiFi 6, which was ratified late last year, will become the de facto WiFi standard in the next three years.

Its key differentiator is that it enables more efficient management of network traffic for a large number of simultaneous users.

Main advantages:

- Increased network capacity through more efficient management of network connections to large numbers of concurrent users

- Increased data speed and throughput of traffic

- Enables upstream multiuser, multiple input, multiple output (MU-MIMO), enabling large data sets to be uploaded in highly dense environments

- Provides power efficiencies through scheduling transaction times to and from devices, which reduces the time that device radios need to be online

The adoption of WiFi 6 is predicted to be fast from the moment network equipment vendors start adapting their products to the standard. Devices will be gradually standardized to support and complement it. IDC estimates that the European WiFi 6 market will grow from $61.75 million in 2019 to $1.6 billion in 2024, at a CAGR of 91%.

Despite the opportunities, the European wireless networking market is very competitive and crowded, so network vendors will need to develop strategies to differentiate themselves. It will be important to clearly define customer targets by focusing on specific verticals and use cases, and to develop offerings tailored to these that focus on aspects such as end-to-end experience, interoperability, security, price, and customer support.

Specific use cases where WiFi 6 adoption will create a tangible improvement include:

- Large public venues — such as stadiums, auditoriums, and schools — where there is a high density of users simultaneously using the wireless network

- Large enterprises, where communications and networking are now mostly done wirelessly and many applications are cloud based

- IoT use cases, particularly in verticals such as manufacturing and retail; these will benefit from WiFi 6, not only because of the more efficient way it enables a large number of devices to transfer data simultaneously, but also due to the power management optimization that WiFi 6 devices offer

Besides the fierce competition faced by network providers, there are other challenges.

First, there are other wireless connectivity types coming to market, notably 5G, which could threaten the WiFi 6 market. Despite this, IDC predicts rapid adoption of WiFi 6, driven by uptake in key verticals to begin with before it becomes the de facto standard across all enterprises in the next three to four years. 5G is still in the early days of deployment, whereas WiFi 6 devices are already being shipped, and there are many use cases where WiFi connectivity will be enough.

Second, as the amount of data flowing across the network and away from enterprise branch environments grows, enterprises will need to upgrade other parts of their network. This could delay some enterprises’ move to WiFi 6, while they wait till their network equipment is ready for a more complete refresh.

In conclusion, IDC sees WiFi 6 as not only a growth opportunity for wireless network vendors, but also an opportunity for vendors with a broader networking portfolio to sell software-defined networking solutions into the enterprise. Given this, IDC expects 2020 to be a dynamic year for the campus networking environment, with many vendors leveraging WiFi network refresh projects to sell SD-branch solutions. To stand out in this competitive market, vendors should focus on key use cases where WiFi 6 will make an impact, then leverage this to open up further network transformation opportunities.

If you want to learn more about this topic or have any questions, please head over to https://www.idc.com/eu and drop your details in the form on the top right.

One Step Closer to the Smart Home of the Future

With consumers becoming increasingly connected, the European smart home market is rapidly expanding and becoming more mainstream. Ubiquitous and pervasive connections are significantly changing consumers’ lives across multiple domains, from how they shop, to how they play sport, to how they interact with their environment, including their home — with the goal to make living smarter, more comfortable, more secure and more entertaining.

This means huge opportunities for technology vendors. According to the IDC Worldwide Connected Consumer Spending Guide, the European smart home device market will reach €56 billion by 2023, growing at a five-year CAGR of 8%.

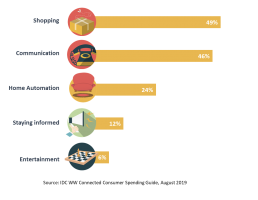

Entertainment accounts for the lion’s share of smart home use cases, driven by watching and downloading movies and videos, but also by smart speaker–related applications such as shopping and communication (with associated spending growing sixfold in the next five years). There are also significant pockets of growth in home automation. Consumers are already spending more on home security devices, but over the next few years investments in lighting and smart speaker technologies are expected to increase more than 40% year on year on average.

Only a few years ago much of this was the stuff of sci-fi, but it is now a reality. Consumers can turn on lights using their smartphone, switch on heating automatically by entering a room and talk to someone at their door from their smartphone.

Three major trends are expected to shape the smart home market in 2020.

The Quest for Standardisation and Interoperability

Competition in this rapidly growing market has led to a proliferation of competing devices and platforms. The risk, for consumers, is being locked into a specific platform or in multiple platforms that don’t speak to each other. This can impact consumer experience and adoption in a number of ways — for example, limiting consumers’ options in terms of the complementary products they can use, making it more difficult to switch from one platform to another, increasing security threats and encouraging consumers to “sit and wait” until a dominant platform emerges.

To address these challenges, smart home leaders such as Amazon, Apple, Google and the Zigbee Alliance (comprising companies such as IKEA, Samsung and Signify) announced in December 2019 a working group, called “Project Connected Home over IP”, to develop a new set of standards to increase compatibility across smart home devices. The project could play a pivotal role in the market, as it’s expected to ultimately simplify manufacturing processes and improve ease of use for consumers while enhancing security and reliability.

More (Artificial) Intelligent Appliances

Growth in the smart home market has been fuelled by ever-smarter machines and technologies powered by deep learning algorithms — making home activities easier and safer and interaction with the technology more personalised and engaging.

How consumers interact with smart devices is also changing, with more players investing in voice-enabled technologies, as this is becoming the main trigger for consumers entering their homes. Being able to do this — activating and controlling smart devices by talking to a smart speaker — improves consumers’ experiences and makes it easier for them to interact with technology. It also enables multitasking, saves time — crucial given the growing number of technology touchpoints — and lowers barriers for non-digital-natives.

Many major smart home players are heading in this direction. At the 2020 Consumer Electronics Show (CES), Signify announced a new voice-control feature in its Philips Hue Play HDMI Sync Box. This will enable consumers to ask their Amazon Alexa, Google Assistant or Apple Siri to turn on their smart lights and sync them with the movies or TV shows they’re watching, the music they’re listening to and the video games they’re playing.

Looking at other CES 2020 announcements, it’s clear that the home of the future will become even smarter. LG showcased a new AI-enabled washing machine that not only detects the weight and volume of each load but also recognises fabric types to set the optimal wash cycle. LG and Samsung also presented new AI-powered fridges that provide a real-time food inventory and personalised suggestions, while Netatmo, a home security provider, showcased new smart keys that enable users to lock and unlock doors using only a smartphone.

Thumbs Up to Sustainability

Consumers are becoming increasingly aware of sustainability issues and this of course is having an impact on their purchasing decisions. Smart home appliances are reflecting this greater awareness, showing consumers how technology can improve not only comfort, security and entertainment but also sustainability. Smart lighting and thermostats, for example, enable users to reduce and optimise energy consumption through temperature and light control. New domestic appliances provide similar benefits, enabling users to reduce energy consumption and cut food and water waste.

At CES 2020 Phyn, a leading smart water management company, presented new solutions that enable users to monitor water consumption and detect water leaks in buildings and apartments. Sustainability also relates to the supply chain and manufacturing process for the production of smart home devices. In November 2019 Signify launched a new service that enables consumers to tailor their 3D printed luminaires made from recycled CDs. Smart home players are taking an increasingly active role in the circular economy, and this will be another key trend to watch in 2020.

These three trends are just the tip of the iceberg when it comes to the massive changes taking place in the smart home market. Companies need to move quickly and effectively, and understand consumers’ evolving needs and the important role of other ecosystem players and influencers, including installation services and manufacturers of complementary products.

The IDC Worldwide Connected Consumer Spending Guide provides market insights on the evolving connected consumer market, with a focus on smart home technologies and use cases.

To learn more, please contact Giulia Carosella, Gabriele Roberti, or head over to https://www.idc.com/eu.

Is Your Cloud Data a Ship in a Bottle?

The cloud conversation has been and gone – no longer a hot topic at conferences and in the technology press, it is now a fact of life. Business as usual.

Still, we are really only starting the journey to public cloud holding the majority of our compute and storage. Our research at IDC tells us that it will take five more years before the majority of organisations spend more than 50% of their infrastructure budgets on public cloud.

We have learned some important lessons in the past few years – not everything that glisters is gold, and whilst living in a world of unlimited compute and storage powered by your OpEx budget can be liberating it can also bite you if you’re not careful. More than one organisation I know of has enthusiastically adopted a cloud-first strategy, only to find they can’t move a lot of legacy applications and find they are now paying for two infrastructure estates.

Additionally, we often don’t factor in a possible data repatriation strategy when we move to the cloud. But we are seeing lots of data moved back out of public cloud when, for example, usage profiles or security considerations change.

If you need to move data out of your public cloud service, are you able to do that without incurring enormous costs? Is there a migration path, or have you inadvertently built a ship in a bottle – never getting out through that very literal bottleneck? If you don’t include repatriation in your cloud strategy, that might be exactly what you end up with.