With consumers becoming increasingly connected, the European smart home market is rapidly expanding and becoming more mainstream. Ubiquitous and pervasive connections are significantly changing consumers’ lives across multiple domains, from how they shop, to how they play sport, to how they interact with their environment, including their home — with the goal to make living smarter, more comfortable, more secure and more entertaining.

This means huge opportunities for technology vendors. According to the IDC Worldwide Connected Consumer Spending Guide, the European smart home device market will reach €56 billion by 2023, growing at a five-year CAGR of 8%.

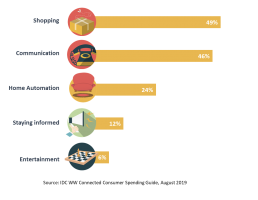

Entertainment accounts for the lion’s share of smart home use cases, driven by watching and downloading movies and videos, but also by smart speaker–related applications such as shopping and communication (with associated spending growing sixfold in the next five years). There are also significant pockets of growth in home automation. Consumers are already spending more on home security devices, but over the next few years investments in lighting and smart speaker technologies are expected to increase more than 40% year on year on average.

Only a few years ago much of this was the stuff of sci-fi, but it is now a reality. Consumers can turn on lights using their smartphone, switch on heating automatically by entering a room and talk to someone at their door from their smartphone.

Three major trends are expected to shape the smart home market in 2020.

The Quest for Standardisation and Interoperability

Competition in this rapidly growing market has led to a proliferation of competing devices and platforms. The risk, for consumers, is being locked into a specific platform or in multiple platforms that don’t speak to each other. This can impact consumer experience and adoption in a number of ways — for example, limiting consumers’ options in terms of the complementary products they can use, making it more difficult to switch from one platform to another, increasing security threats and encouraging consumers to “sit and wait” until a dominant platform emerges.

To address these challenges, smart home leaders such as Amazon, Apple, Google and the Zigbee Alliance (comprising companies such as IKEA, Samsung and Signify) announced in December 2019 a working group, called “Project Connected Home over IP”, to develop a new set of standards to increase compatibility across smart home devices. The project could play a pivotal role in the market, as it’s expected to ultimately simplify manufacturing processes and improve ease of use for consumers while enhancing security and reliability.

More (Artificial) Intelligent Appliances

Growth in the smart home market has been fuelled by ever-smarter machines and technologies powered by deep learning algorithms — making home activities easier and safer and interaction with the technology more personalised and engaging.

How consumers interact with smart devices is also changing, with more players investing in voice-enabled technologies, as this is becoming the main trigger for consumers entering their homes. Being able to do this — activating and controlling smart devices by talking to a smart speaker — improves consumers’ experiences and makes it easier for them to interact with technology. It also enables multitasking, saves time — crucial given the growing number of technology touchpoints — and lowers barriers for non-digital-natives.

Many major smart home players are heading in this direction. At the 2020 Consumer Electronics Show (CES), Signify announced a new voice-control feature in its Philips Hue Play HDMI Sync Box. This will enable consumers to ask their Amazon Alexa, Google Assistant or Apple Siri to turn on their smart lights and sync them with the movies or TV shows they’re watching, the music they’re listening to and the video games they’re playing.

Looking at other CES 2020 announcements, it’s clear that the home of the future will become even smarter. LG showcased a new AI-enabled washing machine that not only detects the weight and volume of each load but also recognises fabric types to set the optimal wash cycle. LG and Samsung also presented new AI-powered fridges that provide a real-time food inventory and personalised suggestions, while Netatmo, a home security provider, showcased new smart keys that enable users to lock and unlock doors using only a smartphone.

Thumbs Up to Sustainability

Consumers are becoming increasingly aware of sustainability issues and this of course is having an impact on their purchasing decisions. Smart home appliances are reflecting this greater awareness, showing consumers how technology can improve not only comfort, security and entertainment but also sustainability. Smart lighting and thermostats, for example, enable users to reduce and optimise energy consumption through temperature and light control. New domestic appliances provide similar benefits, enabling users to reduce energy consumption and cut food and water waste.

At CES 2020 Phyn, a leading smart water management company, presented new solutions that enable users to monitor water consumption and detect water leaks in buildings and apartments. Sustainability also relates to the supply chain and manufacturing process for the production of smart home devices. In November 2019 Signify launched a new service that enables consumers to tailor their 3D printed luminaires made from recycled CDs. Smart home players are taking an increasingly active role in the circular economy, and this will be another key trend to watch in 2020.

These three trends are just the tip of the iceberg when it comes to the massive changes taking place in the smart home market. Companies need to move quickly and effectively, and understand consumers’ evolving needs and the important role of other ecosystem players and influencers, including installation services and manufacturers of complementary products.

The IDC Worldwide Connected Consumer Spending Guide provides market insights on the evolving connected consumer market, with a focus on smart home technologies and use cases.

To learn more, please contact Giulia Carosella, Gabriele Roberti, or head over to https://www.idc.com/eu.