The Evolution of Digital Sovereignty: Moving Beyond Data and Cloud

Throughout 2022, I talked a great deal about how digital sovereignty was evolving, and we now have the evidence to prove it.

Ongoing geopolitical uncertainties, along with macroeconomic trends such as the ongoing threat of a new pandemic and inflationary fears, mean digital sovereignty is shifting gears and emphasis from self-determination to self-sufficiency and survivability.

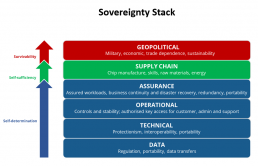

As a result, digital sovereignty encompasses several layers which we present as part the “Sovereignty Stack”:

Organisations that are ready to embrace this broader view of digital sovereignty should consider the following attributes when designing, procuring, implementing and managing sovereign solutions.

Self-Determination

- Data sovereignty: While you may be familiar with data (and cloud) sovereignty, these are just subsets of digital sovereignty (as explained in my video A Few Words on Digital Sovereignty).

Data sovereignty is the starting point that enables organisations to achieve the full stack of digital sovereignty outcomes.

As data regulations emerge and evolve, they should look for technology solutions that provide a holistic view of how data is collected, classified, processed and stored to ensure that data legislation and rules are being met.

- Technical sovereignty: Organisations cannot lock themselves into custom-built solutions that become legacy systems in their own right.

They must aim to work with platform players that can deliver plug-and-play capabilities. Here, open source solutions will lend themselves well to interoperability, as well as data portability and transferability.

- Operational sovereignty: IT executives will seek technology suppliers that offer cloud capabilities that enable transparency in controlling operations, from provisioning and performance management, to monitoring of physical and digital access to the infrastructure.

Transparency equals trust — a fundamental tenet of digital sovereignty.

- Assurance sovereignty: Data availability is essentially all about resilience.

For example, in Europe, this is mandated by rules such as the EU Cybersecurity Strategy, Network and Information Systems Directive, and the Digital Operational Resilience Act (DORA).

The latter defines the principles to ensure that digital infrastructure across the continent’s financial sector is always available to provide critical services.

Self-Sufficiency

- Supply chain sovereignty: As well as reinforcing digital supply chain resilience, the aim here is to strengthen the digital economy’s competitiveness, its capacity to innovate, and ability to create jobs.

Skills sovereignty is also a part of this layer. Here, organisations should expect service providers to invest in knowledge transfer as this can support and foster local talent and empower companies to develop their own digital innovations.

Without this transfer, the much-talked-about IT talent shortage will continue to perpetuate.

Survivability

- Geopolitical sovereignty: IT and digital technologies are now at the heart of a nation’s critical infrastructure.

This takes the idea of digital sovereignty level to a broader, macro level.

As a result, governments as well as business leaders want to use cloud solutions to help deal with the strategic weaknesses, vulnerabilities and high-risk dependencies of an increasingly volatile geopolitical environment.

Note that the attributes you see in the IDC Sovereignty Stack are mutually dependent on one another.

For instance, the easier and more affordable it is to integrate solutions and switch among vendors, the easier the opportunity to promote co-innovation with local companies that create local jobs.

The “Stack” in Action

Since the start of the Russia-Ukraine War in February 2022, a combined 75% of organisations in Europe now consider digital sovereignty to be more important (source: IDC EMEA, FERS Survey Europe, Wave 4, May 10–25, 2022).

As a result, they are either adjusting their operations or changing their IT strategies.

When asked what actions their business and IT leaders were taking due to their increased digital sovereignty concerns, many of the top results seen in the graph below are evidence of the Sovereignty Stack in action.

While improving privacy measures is the foundation of data sovereignty, supply chain management and enhancing resilience in the face of geopolitical volatilities are examples of the “self-sufficiency” and “survivability” layers as depicted in the stack.

Supply chain issues were already highlighted during the COVID-19 pandemic.

Organisations now want to get on top of this and also know the sources of their IT services and goods to ensure business continuity because digital sovereignty is ultimately about operational resilience.

Find out more:

Why Does Digital Sovereignty Matter in Cloud Buying Decisions?

Back to the Future — From Smart Cities to Smarter Planet

I always like to leave some time before writing about the World Smart City Congress in Barcelona to give myself a reality check. The main reason is that while you are with around 20,000 other engaged and excited people from around the globe, it is difficult not to suffer from group think.

It’s always instructive to see who has “gone big” each year and who has cut back, as it reflects how the market is developing. This is equally true of the countries involved and the major themes behind the solutions presented.

Enormous single stands from the likes of IBM and Schneider have come and gone, and new entrants like Mastercard have taken their place, but there is a definite move towards the power of partnership. Global players such as AWS and Red Hat are happy to have a small presence on the Fiware booth. Companies the size of Accenture and Siemens ply their wares from the Microsoft booth and Nvidia and Dell promoted the synergies between their solutions at a combined stand.

This move can also be seen with natural solution curators such as professional service providers. Deloitte ran one of the busiest and most popular stands as a platform for partners to display the depth and breadth of their market reach.

There was a wide spectrum of technology being promoted from smart city 101 type parking and lighting solutions to futuristic visions of the benefits of the Metaverse. What became clear though was that better and more efficient use of data was the force majeure behind many of the solutions being presented.

This was matched by a focus on the security, privacy, governance and ethics of data collection and use. It was heartening to hear tech vendors highlighting trust, democratisation, diversity and sustainability alongside how many new widgets their solution had.

The big difference this year was the emergence of cross-industry partnerships. At IDC, we have been researching the new industry partner ecosystems that will drive the market.

In essence, to achieve the outcomes required from government clients there will need to be a coordinated approach across architectural, engineering and construction companies (AEC), commercial real estate (CRE) and tech vendors. Some AEC companies such as AECOM were at the event and we predict more will be there next year.

The technology solution that was ubiquitous throughout was digital twins. Digital twins evolved from BIM solutions used by AEC and CRE companies and are critical to both visualising data and for scenario planning. Government clients want to see a “golden thread of information” from data collection, through data synthesis into information made accessible by digital twins.

One consequence of the above is that the purview of “smart” has expanded. The original locus was captured by IBM’s Smarter Planet marketing back in 2008 and a recognition that new technologies had fundamentally changed the world.

The tech industry then spent the next decade looking for a customer focusing on cities as the best level of subsidiarity. Arguably, this has been less than successful as cities have never developed a customer with concomitant budget, responsibility and authority to engage in holistic solutions across all the functions of a city. This inability is exacerbated by an election cycle that reduces the ability for long-term planning. Ergo, we are still stuck selling point solutions.

The nascent cross-industry partner ecosystems outlined above provide a much needed expansion beyond City Hall to a return to the smarter planet idea just as we are beginning to recognise that we have a planet-sized problem. Carbon, energy, water and food are the new riders of the apocalypse.

See the Barcelona interview with Jennifer Schooling, director, Cambridge Centre for Smart Infrastructure and Construction, and me here University of Cambridge & IDC | Construction that Maximize Urban Potential (tomorrow.city).

What Will Customer Experience Look Like in Retail?

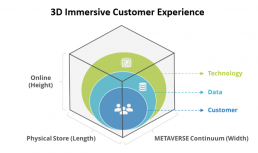

The 3 Dimensions of Retail Immersive Customer Experience

“The opportunity with the Metaverse is it creates infinite possibilities for us to connect, create and belong. […] In essence, how can we help our current members, get educated, informed and show them the way?” Tareq Nazlawy – Senior Director Digital, adidas

Despite the internal and external challenges that retailers must face, real-time contextual customer experience is a key factor for retailers and brands that aims to engage, retain and enhance shoppers’ experiences during different and multiple interactions and interfaces.

According to our Global Retail Operating Models 2022 Survey, brick-and-mortar remains retailers’ main channel source of revenue generation over the next two years. At the same time, eCommerce and marketplaces as well as retail media networks, conversational and social commerce are expected to become new and increasing channels of new revenue streams.

This would allow retailers’ operating models to become fully omni-channel while completely integrate online and physical operations, in real-time.

However, the traditional convergence between online and offline is now nowadays characterized by a third dimension that aims to augment the overall shopping experience, including the metaverse continuum. This ranges from AR-enable visual and image search to 3D product visualization, to more sophisticated and immersive virtual realities for visual commerce, such as Web3 and Metaverse platforms and related NFT capabilities.

At the center of this 3D integration – between online, physical stores, and metaverse continuum – there are three core elements that are foundational of the immersive retail customer experience. The core elements are:

- Customers. Shoppers’ need, behaviour and preference as well as the customer-centric approach that permeates B2C, B2B2C and D2C business models.

- Data. Collecting and managing first-, second- and/or third-party, retailers and brands become key players of partners ecosystems for leveraging customer data platforms (CDPs) and customer data sharing hubs to guarantee data accuracy, security and identity management.

- Technology. AR, VR, digital twin, and Metaverse are (re)emerging technologies that fueled by data and powered by AI and ML analytics, enable retailers to enhance personalization of the customer journey model.

As we have recently published in the IDC FutureScape on Worldwide Retail 2023 Preditions, “By 2024, 65% of Retailers Will Invest in Visual Commerce to Enable Personalization Through 3D Product Configuration and Virtual Try-On and Reduce Complexity Through Image-Based Interfaces”.

There are also concrete examples of retailers that launched metaverse initiatives, such as Nike launching on Roblox; Walmart adopting an AR-powered virtual try-on option for in-app virtual fitting from home; recently, LaCoste opened its Web3 community for Le Club loyalty program members or the Swedish retailer H&M is currently piloting a new tech-enabled collection of style (COS) store — including smart mirrors — with the intention to expand this format soon across all its stores.

These are all examples of retailers already investing on visual commerce-enabling technologies enhancing personalization and customer engagement at the highest level of immersion. To achieve this goal, there are some IT implications to consider:

Frame visual search applications with the overall retail commerce platform infrastructure to enrich a solid customer data base (such as customer data platform) for CX personalization.

Integrate AR/VR to the current in-store technologies (e.g., RFID, sensors, and smart mirrors) to achieve a fully omni-channel experience.

Set the basis for metaverse requires overcoming any complexities deriving from existing customer-facing disconnected interfaces.

Key Actions for Retailers

So, what retailers should do then? Here there are three immediate key actions:

- Include augmented commerce as part of business model innovation, and long-term strategic digital road map use case definition.

- Go or become fully and truly omni-channel implementing those capabilities and technologies that bridge personalization to augmented customer experience.

- Co-innovate along retail metaverse continuum with the right partners to generate customer lifetime value across multiple interfaces and – again! – reducing complexities.

IDC Retail Insights analysts Ornella Urso and Filippo Battaini will be onsite in New York for NRF 2023: Retail’s Big Show. They look forward to meeting you and share their research themes and upcoming IDC initiatives for 2023!

IDC Takeaways from Enlit Europe 2022

This year’s Enlit Europe, which took place between November 29 and December 1 in Frankfurt, attracted almost 18,000 visitors and 1,000 exhibitors from 100 countries — proving once again to be a reference point for the European (if not worldwide) utility sector.

Sessions on flexibility, energy transition, and digitalization, as well as numerous hub sessions, provided a great opportunity for knowledge sharing during the three-day event. Here are our key takeaways from discussions and debates with technology providers and utilities.

- European power DSOs are feeling the pinch due to accelerating demand for electrification and distributed generation. One DSO from the DACH region we talked to said it expects requests for PV connections to increase fourfold this year over 2021 in power terms. A Scandinavian operator said it needed to deploy as much capacity by the end of the decade as it had built over the past century. This was expected, of course, as distribution is where most of the energy system transformation is taking place. But things have now spread to a large and diverse cross-section of the power distribution world and DSOs don’t want to become the bottleneck of the energy transition. Distributors urgently need tools to shed light on the LV level of their grid — for planning, operations, and maintenance purposes — and marketplaces to access and procure flexibility in coordination with fellow DSOs and TSOs.

- Despite the events of the past 10 months, consumers still appear to be an afterthought for most energy suppliers and utilities (and numerous governments) across Europe. With energy and related energy costs top of mind for most customers, it was a great opportunity for companies to create awareness and educate customers on the energy transition, and the critical role they play in making it a reality. But that opportunity has been squandered, with companies failing to deliver on what matters most to customers: high-bill alerts and personalized, meaningful energy efficiency advice. Due to skyrocketing energy prices, energy suppliers are significantly worse off than before in terms of customer satisfaction and net promoter scores. By failing to support customers at a time of need, utilities have failed to change the narrative around them and become trusted energy advisors in the energy transition.

- As the energy transition accelerates, partnering and co-innovation are becoming critical tools to accelerate the development of solutions designed to respond to this acceleration. These are no longer buzzwords on slideware. Co-innovation between utilities and solution providers is happening on the ground and it is slashing time to market by a factor of three on average. There are hardly any strategic product initiatives by established software providers in this space that are not driven in cooperation with a carefully curated group of end users, leveraging design thinking and agile principles. Partnering between the incumbent enterprise and operational software vendors in the utilities space and their specialty counterparts has also accelerated significantly, offering a new procurement paradigm that combines what we call a platform approach to operations with a new wave of best-of-breed.

- The industry mantras of electrification, decarbonization, and energy transition continue to be recited despite the impact of the ongoing energy crisis. While the criticality of climate change can’t be neglected, it appears to some extent that the energy crisis has dampened the urgency for some companies and the industry as a whole to invest in making grids reliable for what’s to come. This is a concern, as some areas are already at risk of bottlenecks, as uptake of EVs, heat pumps, etc. increases. There are numerous European initiatives to foster electrification, such as “Fit for 55,” which will end the sale of new CO2-emitting cars in Europe by 2035, and “REPowerEU,” which aims to install 50 million heat pumps by 2030. But this begs the question: Where are we going to get all this power from”

The overall impression is that of an industry chugging along, conscious that it can’t do it alone and increasingly reliant on its partners and innovation with other sectors. We have seen pockets of real disruptive innovation, but for the most part the industry feels a bit weary, and understandably so.

Here’s to brighter times when we meet in Paris at next year’s Enlit Europe.