Unlocking the Power of Purpose: The Future of Work in the Era of Disruption

The Future of Work is going through a tumultuous time. In a response to tough market conditions, business leaders across industries, including high profile CEOs, are mandating a return to the office. The reason is no more than a desire among managers to boost employee performance by having tighter control over their reports.

Moreover, recent mass layoffs, which are essentially no more than a sugar rush for shareholders, can also be interpreted as a shift in power from employees back to employers. The latter are now in charge, dictating how work gets done for the sake of financial performance.

Will this last? Can we assume that the past few years of progress in the Future of Work have been erased from history?

Are You Ready for the “Era of Disruption”

Returning to a pre-pandemic workplace is not viable. A company with top-down decision making will find it difficult to adapt to a fast-changing environment.

Employees will not give the best of themselves if their voice is not heard, or if they feel disrespected or undervalued. Many will retire early, quiet quitting or even joining the large contingent of gig workers, simply because they feel “they don’t belong”.

The pandemic taught us something profound that goes beyond “where” work happens. It is the realisation that work is a projection of ourselves, our life goals and aspirations, and a means of fulfilment.

Meaningful Work

Brad Bird, the movie director, once said, “Money is just fuel for the rocket. What I really want to do is go somewhere.” This sentence, which reflects the mindset of many people at work today, can be summarised in one single word: Purpose.

With Millennials and Gen Z making up roughly half of the current workforce, and soon becoming our future leaders and CEOs, it is reasonable to expect “corporate purpose” to change business as we know it today. Younger generations want to work for companies with impact, beyond shareholder value.

Purpose is the secret sauce for high performance

Therefore, it’s not “where” work happens but “why” work happens — i.e., the purpose of work that unlocks employee energy. In an era of disruption, when work has direction and is transformed into purpose it is powerful and energising.

Let’s think about a sailing racing yacht, and the teamwork involved to pursue a common goal, a North Star. In a racing yacht, the following applies:

- The interest of the team is always above individual interest

- There is just “one collective head” — they must think and act together

- Every crew member has a critical role to play for the victory, from the leading role of a helmsman to the agile role of trimmers, tuning the sails to ensure maximum thrust.

How does the above apply to your firm? Are your people “energised” to collectively pursue your North Star? Do they feel their roles and responsibilities make an impact?

This is the secret sauce of high-performance organisations: by nurturing their core, business leaders can drive employee performance and team cohesion.

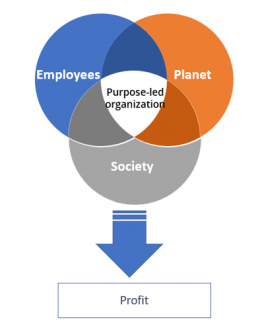

Sustainable companies do business and make profit by placing the welfare of their people, society and the environment as their core purpose. As such, unfair pay, work inequalities, “command and control” management styles and the social disconnect affecting many organisations today is foreign to them.

Companies with a sustainable purpose enjoy a more mature social contract between employer and employees. Thus, the choice of hybrid or full time in the office is actually irrelevant. What matters is that decisions are not top down but in partnership with employees.

Technology Is the Enabler

In a digital world, pursuing the North Star is far more effective (and enjoyable) when employees are given the right technology. Here are some suggestions:

- Devices that are sustainable by design and appropriate for different workstyles

- Digital Workspace solutions for productivity, inclusive collaboration and connection to purpose.

- Workflow automation to free up employee time for more human work

- Online training platforms to continuously elevate employee skills throughout their careers

- Intelligent IT support for employee experience and productivity

- Identity management for digital trust

- Zero Trust security solutions for a perimeter-less workplace

In summary, placing purpose at the core of your business is most effective for employee performance and social cohesion. Numerous third-party studies show that purpose-led organisations outperform their peers.

If you would like to learn more about this and how technology enables a purpose-led organisation, join us at our IDC Future of Work Conference.

Why Listening to Customers and Engaging with Them Are Not the Same Thing

Customer listening. Customer engagement. Both well-established and understood aspects of the customer experience arsenal that many would argue they have already covered within their CX strategies. But have they?

The challenge for many organisations is that they believe they have ticked all the boxes on customer listening and engagement, when in fact all they have done is put in place a few CX tools that are each doing a good job in one part of the CX value chain or another but are operating in isolation of each other.

These organisations fail to realise the business value that is unlocked when these components work together in a single interconnected system. Once understood and implemented as a system of interconnected technologies, a fully functional customer listening and engagement system lets organisations make full use of customer signals to actively drive contextualised customer experiences.

So, what are the moving parts of a fully connected and functioning customer listening and engagement system?

- Signal gathering: the exhaustive capturing of customer signals across all channels

- Data consolidation: once signal gathering is in place, consolidate all customer data into a customer data platform

- Real-time analysis: deploy analysis on your consolidated data in real time to unlock behavioural and intent insights

- Decisioning and engagement: once gathered, consolidated and analysed, a decisioning system is needed to identify next best actions and drive contextualised and orchestrated experiences

These components will no doubt sound familiar, because many enterprises have already installed one or more of them, or plan to. In a recent IDC survey of European enterprise CX technology decision makers, we found that for each of the four components of customer listening and engagement, 80% of enterprises have already implemented the technology or plan to do so in the next 12 months.

So there is a tremendous amount of buy-in for these individual components. But the challenge is that too many organisations are treating them as individual tools, with each one brought in to address a specific business need at a point in time.

To maximise the benefits of a full customer listening and engagement system, all four components need to be in place and working together. But in our survey, we found that only 8% of enterprises have all four of these critical components installed, meaning most organisations are a long way off systematically leveraging customer signals to create differentiated contextualised experiences.

Customer Signal Gathering

What we mean by customer signals are any indication of what a customer is doing or intends to do with a brand. A fully optimised customer signal gathering system is one that takes in signals from across the whole estate of channels that customers use, truly reflecting the omni-channel customer journey. This includes long-established voice of customer systems that many organisations already have in place, based on survey-powered feedback-gathering mechanisms.

Customer signals also include not just conversations customers have with a brand, but also those conversations they are having about a brand. Many organisations are also deploying social listening and analysis tools to capture this. There are also the insights that can be harnessed from organisations’ customer engagement systems themselves.

All the data generated across the value chain — sales, marketing, onboarding, support and service — can shed light on customer behaviour and intent. All of this represents a myriad of customer signal sources. The question is: are you capturing all of them and are you doing it systematically? An optimised customer signal gathering strategy should ingest signals from all these sources.

Data Consolidation

Having exhaustively captured customer signals from all sources, organisations then need to house all this data in a single destination — a customer data platform (CDP) — to create a single version of customer truth. Data silos are one of the major barriers preventing organisations from getting a unified 360-degree customer view.

For organisations that want to leverage all the customer signals gathered from these sources, the CDP is a critical part of the customer listening and engagement system. More organisations are starting to recognise this. In IDC’s latest Future of CX Predictions, we predict that by 2024, 50% of the G2000 will adopt CDPs such as enterprisewide central nervous systems.

Real-Time Analysis

With all of this customer data now housed in a single destination, the key to maximising the insight extracted from it is to employ an analysis system continuously and in real time. Done right, this lets organisations respond to signals — both positive and negative — at the time they are happening and enable them to respond to customers with highly relevant and contextualised responses.

One of the most powerful examples of this is responding to customers at risk of attrition — a moment of truth identified in our recent survey of CX decision makers as among the top benefits of a customer listening and engagement system. CX leaders want to be able to act on signals of attrition in real time and rescue defecting customers, generating true business value, rather than just reporting on it after the fact.

Decisioning and Engagement

This is the final component of customer listening and engagement and this is where the “rubber hits the road” and where customers really see the difference from organisations that run a fully functional customer listening and engagement system. This is where an organisation translates all those signals, the 360-degree customer view and the real-time analysis into next best actions — the actions the data tells us are the next best steps for a customer, in the context of all their interactions and their journey with the brand up till this point.

The biggest problem with traditional voice of customer systems in the past is that they focused on data gathering and were too disconnected from systems of engagement — so listening did not lead to enhanced customer engagement. In the customer listening and engagement system, these are intrinsically linked and work in concert, enabling brands to create experiences that are contextualised and orchestrated in direct response to the signals gathered.

Take Customer Listening and Engagement to the Next Level

For organisations looking to create differentiated experiences through customer listening and engagement, conduct an audit of your CX stack — understand what moving parts you already have in place and work on filling in the gaps in your customer listening and engagement infrastructure. Critically, focus on creating the linkages between the components and ensure they connect well and work together as a unified system — from signal gathering to data consolidation to real-time analysis to decisioning, orchestration and engagement.

Select the vendors that can provide the necessary connectivity between these layers to create a unified system with the full suite of capabilities, rather than a collection of individual tools completing individual tasks in isolation.

Impact of Digital-Native Businesses on Traditional Organisations in Europe

Digital technology is reshaping business models, revenue streams and operations management. At the same time, the rising number of start-ups, scale-ups and unicorns in Europe — the digital-native businesses — is helping to boost digital transformation (DX) initiatives in traditional organisations.

What Is a Digital-Native Business?

Digital-native businesses (DNBs) are highly dependent on a digital infrastructure and are built from the start around modern technologies, from cloud-native applications to artificial intelligence, with data across all aspects, from operations to business models and customer engagement. By adopting new and emerging technologies, and using platform services and marketplaces, DNBs can quickly grow and scale up their business, creating new markets and disrupting traditional business models across industries.

DNBs are also defined by their market valuation — start-ups are valued at less than $250 million, scale-ups are valued from $250 million to $999 million and mature digital natives are valued at $1 billion or more. They can also be either technology-orientated companies (e.g., innovative ISVs/SaaS providers, selling technology products, software or IT services to other businesses) or technology-driven B2B or B2C companies (offering tech-enabled products or services respectively to business or consumers).

What Impact do DNBs have on Traditional Enterprises?

DNBs are disrupting some industries more than others. Fintech companies such as Revolut in the UK and digital banks such as N26 in Germany have pushed digital innovation in the past few years into a very traditional sector, whereas Sweden-based Spotify has completely reshaped the music industry at a global level.

DNBs’ influence also extends to the way traditional companies adopt and use technology. DNBs’ tech operations are often cloud native and data driven, with a customer-centric focus, employing tech-savvy developers and data scientist teams in agile environments to grow and scale the business quickly.

Market disruption and the growing interaction with DNBs are driving traditional European organisations to adopt some of the DNBs’ distinguishing digital features, such as shifting towards a digital-first organisational approach across the enterprise. According to IDC’s What Is the Impact of Digital-Native Businesses on Traditional Enterprises? — based on IDC’s 2022 European Industry Acceleration Survey — these impacts include:

- Increased innovation: 35% of businesses with more than 1,000 employees cited this. Healthcare (37%), government/education (34%) and transport (34%) are the most impacted industries. Healthtech, edtech and the shared economy are the fastest-growing segments in the DNB arena.

- Adoption of new working models: The implementation of agile, remote and hybrid ways of working pushed by the interaction with DNBs is most common in very large enterprises, government, education, and retail and wholesale industries. These extensively adopted remote working during the pandemic, and are now taking inspiration from DNBs to permanently adopt new and flexible working models.

- Higher proportion of digital personnel: Finance respondents have increased the share of employees with digital skills (38%), and have a greater focus on customers and CX (31%), a trend influenced by the interrelationship with the fintech ecosystem. On a broader level, medium, large and very large organisations also say DNBs have had a major impact on organisational changes at the C-suite level.

Why Is it Important to Monitor the Relationship Between Digital Natives and Traditional Businesses?

IDC’s European Industry Acceleration Survey highlights growing coopetition between DNBs and traditional organisations. This is leading to a more innovative and digital-first organisational approach for the latter, such as a tighter focus on digital revenues, across all size categories, and greater competitive pressure in their respective markets, which may enable them to enter M&As or investment activities with DNBs.

This last trend is more prominent for utilities and oil/gas respondents, an industry where customer-orientated digital natives have pushed traditional companies towards improving their CX, also by acquiring entirely digital organisations in the process and with new market segments (such as renewables) being led by digital-native businesses.

Tech providers should target European DNBs, as this is a competitive, fast-growing segment populated by lean, agile and tech-enabled organisations. DNBs are built around modern technologies and digital infrastructure, and need to enter strategic partnerships with external stakeholders to meet their need for innovation. Tech providers are the first option for European DNBs, according to preliminary results from IDC’s Global Digital-Native Business Study.

Tech providers should also look to DNBs as precursors of the changes and trends that will affect traditional industries. Changes range from greater adoption of cloud services (cited especially by telecommunications and media, finance, and professional services respondents) to the adoption of a data-driven approach to business outcomes (cited by 19% of very large enterprises and 25% of retail/wholesale respondents). What DNBs need today will be what traditional businesses need tomorrow.

The relationship between DNBs and traditional organisations could span from tech supplier to potential acquisition target. This could change based on their business model, giving birth to interconnected ecosystems. For these reasons, in cultivating a long-term relationship with digital natives, tech vendors can also improve their positioning in traditional enterprises as trusted partners in their DX journeys.

To find out more about digital-native businesses in Europe, please contact Martina Longo.

Top 3 Regulatory Concerns of European Organizations for the Next Two Years

European organizations expressed their concerns and the impact the believe they will face from Regulations in the coming years of 2023 and 2024, when asked about it in the European Enterprise Acceleration Survey (n=1500). The survey was conducted in late 2022 and we found that the top three priorities for European organizations are in the domains of Cybersecurity, Data Governance and Sustainability.

However, the perception or Regulatory impact varies within European regions, as the political and economic differences reflect in organizations’ regulatory focus for the coming years.

For instance, Western Europe and Central Eastern Europe bear significant differences as the organizations from Western Europe are more concerned about Sustainability Regulations and Safety of products (quality). Meanwhile, organizations from Central Eastern Europe see a higher impact coming from Cybersecurity and Privacy regulations.

Central Eastern Europe

Given the geopolitical context with the war on Ukraine, countries like Czech Republic, Poland and Romania have the highest concern about Cybersecurity Regulations. Those countries have already felt the geo-economic impacts of the conflict in Ukraine, and organizations can find themselves in a situation of lack of compliance with both EU and local regulations.

Particularly in the Czech Republic, there has been a push for Cybersecurity regulations by the National Cyber and Information Security Agency (NUBIK) in the last 5 years, as well as a dependency reduction from foreign parties since the war started in Ukraine. Lukáš Kintr, Director of NÚKIB, commented on the progress of the new draft legislation on high-risk suppliers assessment of technology: “The Czech Republic can have a comprehensive system for reducing the state’s dependence on untrustworthy foreign suppliers within two years. In the field of information technology, we hope to avoid the situation we are currently observing, for example, in connection with oil and gas supplies from the Russian Federation.“

Moreover, with the upcoming application of the NIS2 Directive, several industries included in the Critical Infrastructure category will be touched by the new security requirements. As the tighter Cybersecurity Regulations in the EU comes to place in the next 18 months, EU countries will need to transpose it into national laws and organizations will need to understand how to implement those.

Western Europe

Western Europe organizations hold the same pattern without great discrepancies and have a balanced Regulatory impact assessment profile. Some specificities can be found in France, Netherlands and the UK.

France

France has the highest concern with Ethical-AI Regulations in Europe. France has started to roll-out their policies about the topic from 2018 on, following the publication of the National AI strategy, and the creation of the French National Committee for Digital Ethics.

The country has been historically a leader in the Ethics of technology and AI policymaking, not only from a restriction and liability standpoint but also from a talent and skills investment perspective.

Netherlands

Netherlands is the country with the highest perceived impact of Privacy Regulations, given the high degree of awareness of their citizens and therefore the concern of Dutch organizations. Even if Germany is the leading country on the Privacy subject, Netherlands leads the Privacy Impact Assessments (an instrument for determining privacy risks of data processing in advance).

United Kingdom

The UK is the Western European country with the greatest focus on Data ownership and control regulations, hence the Digital Regulatory misalignment caused by Brexit and the harmonization needed for UK organizations to keep operating in European countries.

Nordics

On another sub-European region, the Nordics, we see yet another response to the contextual geopolitical challenges. The highest regulatory impact perceived by Nordics organizations is around Digital Sovereignty Regulations.

This is explained by the perceived risk of the geographic proximity to Russia, and the increase of the state-sponsored attacks to Nordic countries, especially after the beginning of the war on Ukraine. As the region has the highest digital maturity of European, the direct cyber response is in place (updated infrastructure, high cyber skills, security systems in place, etc.) and new concerns about business implications of the geopolitical context arise.

The Nordics has nonetheless the highest perception of impact coming from Sustainability Regulations in Europe. Historically, the sub-region has had the most relevant political push for green and environmental regulations.

Norway has a number of local regulations around the ESG dimension, such as the Transparency Act, which will required amendments to be compliant with the new Corporate Sustainability Reporting Directive from the EU. Organizations in the Nordics, even if very advanced in terms of compliance with ESG-related Regulations, have to juggle with tighter requirements and uncertainty of the compatibility of the national and EU regulations.

Recommendations for Tech Providers

- Geo-based sales enablement: Base your go-to-market strategy, sales message and product offerings on the regulatory priorities of organizations for the next two years, taking into consideration not only industry but specific geography (sub-region and country).

- Target the top regulatory concerns across the continent: European organizations will be required to comply with many new or update regulations at the EU and local level. Target the three top areas first: Cybersecurity, Data Governance and Sustainability.

- Focus on technology to help automate compliance procedures: Technology should be a facilitator of the compliance process. Provide your customers with Digital Regulatory Intelligence Solutions, the technologies for monitoring, data processing and reporting.

If you want to know more about this Research, access the report or contact Anielle Guedes.