Understanding Employee Work Motivation and Organization Implications

In March 2022, IDC asked 885 European employees that had confessed to be looking for alternative employment about their motivation for doing so. The top reason was, unsurprisingly, better pay. What was more interesting was that “better working environment (i.e., a better employee experience)” was almost as high among the reasons for job change. It showed that today, work is less about paying the bills and advancing a career. It is much about personal development and fulfillment, as well as being a social and collaborative experience.

One year later, in March 2023, similar questions to 790 employees that were looking for a new job. The proportion of employees citing “better work environment / better corporate culture” was 48%, up from 42% the year before, and just 1% point behind “better pay”. So, not only are the ‘soft’ values important to employees, but they are becoming more and more important. Inflation could also play a role in this detachment from the “hard work” paradigm (i.e. hard as working hard to reach higher levels in the company / higher level of salary). The price increases undermined salaries and dream of the salary-based buying power that we saw previously.

Is it become the strenuous, ‘blue collar’ jobs are disappearing while ‘white collar’, knowledge worker jobs are taking over? The data does not support this hypothesis. All workers, regardless of whether they are desk workers or store/factory/field workers have “better pay” as the #1 motivation to look for a new job. Also, all workers have “better work environment / better corporate culture” as a key motivation for looking for a new job. Knowledge or desk workers are relatively interested in a better corporate culture, while store/factory/field workers are relatively interested in better teams / change of colleagues. Instead, it looks like all work types are becoming more knowledge intensive and bigger part of the individual identify, which prompts all employees to place higher value on work environment, culture, leadership, etc., as opposed to pay.

Dissecting “Employee Experience” to Understand Employee Work Motivation

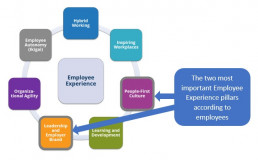

In the March 2022 European employee survey, we also set out to understand which aspects of “employee experience” were more important to employees. We defined seven fundamental aspects of employee experience and asked the employees to rate these in terms of importance. We discovered that relatively ‘soft’ aspects of work, namely corporate culture and leadership & employer brand, were the most important factors of the seven, and more important for employees than we previously assumed.

In the March 2023 European employee survey, we wanted to deep dive into the work culture and leadership aspects of the employee experience. In other words, we wanted to find out what was behind the emphasis on these topics among European employees. Again, we asked employees to rate the importance of a number of subtopics underneath work culture and leadership.

The result showed a remarkable drive amongst the employees for purpose in their work, for a sense of meaningful contribution, for personal development and for fairness. This applied to all types of workers, from desk workers over field workers to staff in stores/warehouses/factories. This drive for purpose implies a number of employee requirements around open communication, leadership integrity, fairness in recognition and compensation, etc. And these requirements are indeed reflected in the top aspects of the two pillars under investigation, work culture and leadership, respectively, as shown in the figures below.

General Implications for Organizations: New Leadership Styles Are Called For

Gone are the days of secluded top managers running organizations in separation from the myriad of employees carrying out instructions and work. Most management experts might comment that this ‘new’ style of open, visionary, and inclusive leadership have been practices for decades already. However, the results of both the 2022 and 2023 surveys suggest that most European organizations still have far to go. The survey data showed that the two most important employee experience pillars, “People-First Culture” and “Leadership and Employer Branding”, were also the two pillars with the largest gap between importance and employee’s rating of their current employer. In other words, the two pillars of the highest level of disappointment with the current employer.

The survey data also showed that for the detailed aspects of these two employee experience pillars, the most important aspects were also the aspects with the largest improvement potential. “Open and timely communication” sounds easy but is often very difficult to carry out successfully in practice. Among the general implications for organizations are:

- Leadership development, especially in the area of soft skills, is critical.

- Executive search must place higher emphasis on aspects such as empathy, integrity, and communication skills.

- Enhancing work culture and leadership communication are new strategic areas where HR can make a difference for organizations.

Implications for HCM Software Vendors: New Solution Types Will See High Demand

Software solutions also have a role to play in remediation of the current culture and leadership shortcomings. In many cases, new HCM solutions will be needed to improve processes related to communication, recognition, compensation, and recruiting. We see particular opportunities in the areas below:

- Compensation management

- Management development training

- Pay gap and Environmental, Social & Governance (ESG) analytics

- Employee engagement & rewards

- Employee performance management

- Recruiting solutions & applicant tracking solutions

Please see the following IDC studies (behind paywall) for more information:

- Building Blocks of a Better Employee Experience (August 2023)

- A Deep Dive into People-First Culture: Results from IDC’s March 2023 European Future of Work Survey (July 2023)

- Hybrid Working in Europe: A Deep Dive into IDC’s Hybrid Working EX Pillar and What European Employees Are Saying About It (September 2022)

Smart Hospitals: Pioneering Sustainable and Resilient Care through Energy Efficiency

The healthcare industry is one of the largest and most sophisticated energy consumers. It is responsible for 4.4% of carbon emission globally.

Hospitals, for example, are typically among a territory’s most energy-intensive buildings. A plethora of medical equipment and healthcare facilities, on which patients’ lives depend, necessitate 24/7 power supply.

And within the same hospital, each of those facilities and departments has their own requirements in terms of access, lighting, temperature and humidity, cleanliness and air filtration, availability of water, power, medical gases, and communications.

However, European hospitals must prioritize the efforts to reduce energy consumption (and limit their carbon emissions in the process) without impacting the quality and safety of day-to-day care. 56% of healthcare organizations consider energy efficiency very important or extremely important (IDC Future Enterprise Resiliency & Spending Survey, May 2023) to limit the impact of unplanned outages on care services and achieve their strategic goals.

In this context, new regulation guidelines, such as carbon neutral Europe 2050, are driving investments to build smart and green healthcare infrastructures, with new hospital projects. Many of the funding related to healthcare sector recovery and resilience have been focused toward promoting sustainable investments, circular economy models, and expanding on the results of preexisting initiatives, as for example on green public procurement or the adoption of environmental management and audit systems.

The strategic intent is the alignment of the hospital core strategy with the sustainability strategy, where actions towards sustainability goals go beyond carbon footprint but also on building stronger adaptive capacity to respond to the changing demands, delivering higher quality, healthier and greener outcomes.

Energy efficient smart hospitals, in fact, can deliver important cost savings and sustainability benefits at the same time, while enhancing adaptive capacity and resilience along the healthcare value chain.

Download eBook: Sustainability in EMEA: Opportunities for Tech Vendors, Challenges for Tech Buyers

Making Sustainability a Top Priority

While primarily built on new sustainable and environmentally friendly standards, energy efficient smart hospitals also adopt efficient and renewable energy applications in hospitals to create healthier healing and work environments, to reduce waste and improve environmental performance.

Energy efficiency is one of the key areas of sustainability initiatives. Our research confirms the strong connection between sustainability and healthcare providers’ key priorities and mission (IDC Future Enterprise Resiliency & Spending Survey, May 2023). Healthcare organizations, implementing sustainability in their operations, have experienced, or are expected to experience:

- Improved financial performance (48%).

- Improved patient satisfaction (42%).

- Improved attractiveness for existing and potential employees (40%).

However, achieving greater and stronger sustainability is not the unique reason to boost energy efficiency efforts.

Re-shaping the Care Delivery Model to Be More Resilient Now and in the Future

Healthcare systems are currently working to renew the care delivery model and enhance hospitals to be more flexible to react to unforeseen events in the future and to the continuous market dynamics effects. The rising costs of energy and its impact on the overall operational efficiency are driving investments into IT infrastructure energy improvements to modernize the entire value chain to deliver higher quality, healthier and greener outcomes, positively impacting patients’ lives.

A good heating system correctly managed, for example, helps to reduce energy wastage whilst improving internal comfort conditions at the same time. Similarly, energy innovations like automatic lighting controls or the advantages of a natural and well-managed ventilation system for infection control are essential to eliminate the airborne bacteria in operating theaters and on the wards.

Embracing this new investment logic along the value chain will contribute to delivering better quality care in a more innovative way. In the long term these advantages will be translated into a more adaptive capacity and resilience of the hospitals to tackle operational challenges through a more energy efficient value chain.

Register for the webcast: Sustainability in EMEA: The Challenge of Moving from Ambition to Action

Realizing the Value of Technology Innovation

To achieve a more sustainable, efficient, and resilient approach to care, hospitals must invest in technology innovations. For 83% of healthcare organizations, a portion between 1% and 10% of their IT budget is already driven by sustainability-related actions.

From next-generation genomic sequencing to cloud computing or virtual care, technology innovations are supporting hospitals’ broader sustainability efforts. The benefits are, for example, in terms of a more efficient infrastructure, better access to health services and reduced energy consumption to travel to physical care settings.

Hence, it doesn’t surprise to see IT equipment vendors on top of the list of players to engage with when it comes to sustainability projects.

And I am sure this is just the start.

Stay tuned for upcoming research on topics such as technology innovation for more energy efficient smart hospitals and digitalization as a key enabler of ESG goals.

For any further information please contact Adriana Allocato, Research Manager, IDC Health Insights, Europe.

The Critical Role of FinOps in Europe and How Vendors Are Recalibrating to Serve Sensitive Customers

2023 is the year of efficiency and IT optimization.

Cloud computing continues to play a central role for European enterprise IT, so are IT costs. Consequently, avoiding or reducing cloud resource waste is a top C-Suites’ priority.

FinOps is fast becoming a critical part of IT organizations’ strategy for its systematic approach to managing costs and optimizing cloud resources. It provides insights into spending, usage trends, and preferences as well as helps in forecast and change management.

Why FinOps Is Important in Europe

In today’s fast-paced world, inflation, skills gap, supply chain disruptions, and political tensions are reshaping the tech landscape and have significantly impacted IT spend in Europe. In fact, European businesses are more likely to pay more attention to their costs and spendings.

In Europe, public cloud pricing complexity is causing a tremendous shock to customers. In fact, SaaS and software application costs related to licenses and subscriptions are the second and fifth categories that had the greatest impact on costs, according to IDC EMEA, FERS Survey Europe, Wave 1: January 20 – February 3, 2023 (N=340).

Not surprisingly, increasing vendors pricing (43%), impact of recession on expected business revenue (23%), and staff/labour shortages (22%) are among the most concerned risk factors related to the European organizations’ tech strategies and budget in 2023, according to IDC EMEA, FERS Survey Europe, Wave 5: June 2023 (N=340).

This is bringing additional scrutiny on cloud spend and cloud ROI. Over two thirds of European organizations believe their total cloud spending is not properly utilized, according to IDC European CloudOps survey, 2023 (N=1,057). Here is where FinOps comes in.

Already 46% of organizations have adopted FinOps in Europe, albeit with varied levels of maturity. But the direction of travel is clear, and it brings huge opportunities for cloud vendors to mitigate cost risks around unused resources, costs allocation, and sustainability as a direct result of waste reduction.

Concurrently, FinOps is seen as a solution in Europe, with some cloud vendors to be very active in the first half of the year. IBM, for instance, has just acquired Apptio to enhance its leadership in the FinOps space while Datadog introduced Cloud Costs Management, which further enhances the collaboration between FinOps and engineering teams to remove friction and reduce cloud costs.

Public cloud vendors are acutely aware of the cost pressures and are investing in offering native cost optimization capabilities.

For instance, AWS Cloud Financial Management (CFM) is aimed at helping organizations measure their AWS environments’ cost while providing prescriptive guidance to cost-related pain points such as lack of visibility or instance sprawl or workload rationalization. Microsoft Azure provides multiple features such as Azure Pricing Calculator and Total Cost of Ownership Calculator (TCO) to help users estimate cloud costs.

It has Azure Resource Manager to allocate costs through the creation of tags, and Microsoft Cost Management to report, benchmark, and forecast costs. Similar tools are offered by Google Cloud Platform too. It has Pricing Calculator and Rightsize Recommender to help users compare architectures costs and provide insights on whether and where to save money.

Enterprises are looking to optimize their cloud resources, control their cloud costs, and deliver innovation while creating value to both their businesses and customers. FinOps is focused on long-term value and reliability, but the outcome of an efficient implementation can already be seen in the short time through the optimization of operations and cutting costs.

Cloud spend discipline is essential and FinOps is seen as critical now more than ever before. The good news is this demand is driving a lot of cloud vendors and third-party niche vendors to offer cost visibility and optimization recommendation platforms. It is an interesting and dynamic market, one to watch closely.

Contact Filippo Vanara to learn more about IDC’s European FinOps Research.

Operationalizing Circularity at Scale in Manufacturing

We are a very inquisitive species with a remarkable long-term record of adaptation and with even more remarkable recent accomplishments in making the lives of most of the world’s population healthier, richer, safer, and longer. Still, fundamental constraints persist: We have changed some of them through our ingenuity, but such adjustments have their own limits.

— Vaclav Smil, How the World Really Works (2022)

The industry sector needs resources more than ever, particularly rare minerals. Even as the hunt for such resources intensifies, the industry is pushing to achieve sustainable growth and meet new environmental, social, and governance (ESG) goals.

According to the Copper Alliance, renewable energy systems require up to 12x more copper than traditional energy systems. Copper demand is expected to increase nearly 600% by 2030.

Renault’s Chairman Jean-Dominique Senard told Reuters news agency: “If there’s a real geopolitical crisis, the damage to battery factories solely powered by products coming from outside will be considerable.”

According to the UN’s Intergovernmental Panel on Climate Change, reducing industry’s greenhouse gas (GHG) emissions requires coordinated action across value chains. Such action includes circular material flows and transformational changes in production processes.

The manufacturing industry remains at the forefront of efforts to reduce the impacts of extracting natural resources and to secure materials that enable low-carbon production. But to meet these and other challenges, organizations must continue to find efficient ways to transform their value chains into closed-loop flows of the basic materials needed to extend product lifetimes. And they should double down on their recycling programs by finding ways to turn materials from end-of-life products into completely new products.

A series of game changers have been pushing organizations to be more efficient with resources and to adopt the principles of the circular economy. These include:

- Organizations have been adopting sustainability policies that call for them to reduce their carbon footprints to at least net zero.

- The massive spread of electromobility has turned the EV battery business, and the rare minerals needed for such batteries, into critical assets.

- The COVID-19 crisis showed that it can be risky to depend on third parties to transport strategic materials around the world.

- Digital technology has developed significantly in the past three years, especially in terms of cloud-based digital platforms and IT infrastructure, artificial intelligence-powered digital tools, and generative AI engines.

Manufacturing organizations, at least in theory, are in an ideal position to make circular principles inseparable from operations. Operationalizing circular principles at scale, however, remains one of the biggest challenges for managers across lines of business and industries.

In IDC’s 2022 global survey of 1,300+ manufacturing organizations, 58% of respondents said they have already incorporated circular economy principles into operations including design and production processes, waste reuse, and local sourcing of resources. Two-fifths (43%) of respondents said that shrinking carbon emissions and their CO2 footprints are key elements of achieving their ESG/sustainability strategic business goals. Two-fifths (41%) of respondents also cited the goals of reducing waste and driving cost efficiencies.

Reduced carbon production, as well as cost reductions driven by the optimized use of materials, labor, and assets, are some of the benefits organizations are receiving after adopting circular economy principles.

The auto industry is pioneering circularity principles in operations, particularly in the area of EV and EV battery production.

- In 2022, General Motors announced an initiative to recover and reuse the raw material in its Ultium battery packs, thus driving down costs and making the manufacturer’s EVs even more sustainable.

- Stellantis established a Circular Economy Business Unit whose objective is to “extend the life of vehicles and parts, ensuring that they last for as long as possible, and returning material and end-of-life vehicles to the manufacturing loop for new vehicles and products.” According to the company’s website, multi-brand parts that are still in good condition are recovered from end-of-life vehicles and sold in 155 countries through the B-Partsecommerce platform.

- Renault’s “The Future Is NEUTRAL” entity aims to scale the closed-loop automotive circular economy, with the aim of moving the automotive industry toward resource neutrality.

These are all great initiatives that seek to improve material resiliency, make more efficient use of resources across the value chain, slow the impacts of climate change, and deliver sustainable profit and increased customer trust.

Download eBook: Sustainability in EMEA: Opportunities for Tech Vendors, Challenges for Tech Buyers

Operational Challenges

The following is a brief rundown of the operational challenges that organizations must tackle to reach a meaningful level of profitable circularity.

- Fragmented Approach: Many organizations lack a clear, unified strategy and circular principles are thus applied opportunistically, mostly in production areas where the effort can bring immediate benefits or solves obvious issues.

- Logistics: Many organizations struggle with insufficient production infrastructure and related logistics. Applying remanufacturing and repair to current operational setups significantly reduces overall efficiency during production, warehousing, and delivery processes.

- Transparency and Flexibility: Implementation of circular principles in operations requires absolute transparency, traceability, and operational flexibility. To secure circular principles during the entire life cycle of the product, data related to the product’s usage must be captured and shared in real time in an autonomous, touchless way.

Faced with these challenges, a digital thread — a closed loop between the physical product and its digital representative — can provide relevant feedback to the product’s lifetime stakeholders. To make such data flows reality, however, several technology elements must converge, including ubiquitous connectivity, IoT, digital twins, and data capturing and sharing via cloud-based digital platforms.

Detailed transparency requires seamless integration of enterprise software. Examples of such systems include product life-cycle management, bills of material hierarchy, enterprise resource planning with remanufacturing functionality, logistics management, manufacturing management platforms, and servicing platforms.

Up-front costs and investments can be significant barriers to circularity. Achieving meaningful impact at scale requires coordination across functions and the involvement of various stakeholders inside and even outside of the company.

Suppliers, reverse logistics providers, remanufacturing and repair centers, customers, and technology partners must be coordinated into a perfectly synchronized machine. A circular environment is far more complex than traditional chains. Organizations may be challenged to create a business case with a short ROI.

Organizations must also determine whether circular principles can be applied to a product that is already in production — or if circular product design and management should instead be implemented only for new products, at the beginning of their life cycles.

Going “circular native,” as I term this last option, was very important to 46%, and extremely important for 38%, of respondents to an IDC Manufacturing Insights survey. “Circular native” is not defined by materials or extended life cycles but by a connection via digital thread to data sharing across a product’s entire lifetime.

The operationalization of circularity requires solid collaboration among procurement, engineering, and supply chain managers, especially during the design and supplier selection process.

It must also be acknowledged that the complexity of supply chains can make it challenging to establish closed-loop systems. Collaboration and coordination among suppliers, customers, and other partners are necessary for efficient material flows. And resource recovery must be underpinned by digital technology (e.g., cloud-based supply chain control towers).

Register for the webcast: Sustainability in EMEA: The Challenge of Moving from Ambition to Action

Boiling the Ocean?

For some leaders, embedding circularity principles in manufacturing operations — including reengineering product specifications according to circular principles — may feel a bit like “boiling the ocean,” or undertaking a seemingly impossible or unnecessarily difficult task.

Yet there are a great many benefits to providing data on technology processes and supply chains to stakeholders in real time. Products connected via digital thread to closed-loop stakeholders can help organizations better manage the product’s life-cycle bill of materials, collect data to improve the next generation of the product, and contextualize product data with current point-of-use data to provide a complex view of the product’s life-cycle status.

To achieve circular economy success, circular principles must be embedded across the entire product life cycle, including packaging. And the digital twin of the product must be integrated with a cloud data platform.

Circularity is not just about utilizing sustainable and recyclable materials: Life extension is a significant element. The most sustainable material is one that doesn’t need to be processed. Repair and remanufacturing are thus integral steps of the product life cycle.

Circularity also requires investments in digital tools capable of handling manufacturing processes in which input and output indicators may not always be well defined. Manufacturers that tackle this challenge should consider dedicated software enhanced with features like reverse bills of material, disassembly, expected recovery and kitting, remanufactured parts management, and remanufacturing pricing with core changes.

Data and contextualized life-cycle information, including carbon emissions, is a real enabler of the optimization of circularity principles in the manufacturing and supply chain environment.

In today’s hyperconnected world, moving from fascination with, to visualization, to implementation of circular principles isn’t viable without reliable and secure digital infrastructure, relevant digital tools, and AI-powered technology.

Bottom line: When it comes to securing material resiliency and achieving ESG goals, there is no time for hesitation or inertia!

To find out more about manufacturing visit our website, or to find out more about the framework-based guidance on how manufacturers can develop and deploy circular principles in their operations, click here.