Transforming Industry Ecosystems with Digital Twins: From ‘Egosystems’ to Ecosystems

In today’s rapidly evolving digital landscape, one concept is consistently making waves across all sectors: digital twins. Digital twins serve as virtual replicas of physical entities, systems, processes, organizations, or ecosystems, offering real-time insights into their operations.

Unlike static representations, digital twins dynamically mirror in real time the life of their physical counterparts. Twins empower organizations to optimize performance, predict issues, and uncover valuable insights previously out of reach.

Previously mostly confined to sectors like manufacturing and energy, digital twins now span diverse industries. Evolving from specialized solutions, they’ve become versatile tools for enhancing operations and guiding decision-making processes.

Digital twins facilitate ongoing operational improvements by dynamically adjusting to evolving operational parameters, environmental factors, and human input. This synergy of digital capabilities and human expertise fosters a culture of continuous operational excellence and refinement.

But with this rapid expansion comes the challenge of defining, implementing, and maximizing the true value of digital twins.

Industry Transformation: Innovative Applications of Digital Twins

In today’s ecosystem-driven world, digital twins are key to industry transformation. Inherently flexible, digital twins scale from entity representations to encompass entire interconnected enterprises and ecosystems, offering a comprehensive view of assets, operations, and partners. They enable organizations to model, monitor, and predict the behavior of the various components of the ecosystem to facilitate adaptation as conditions change and to drive innovation.

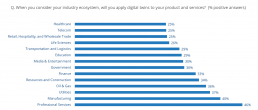

Our research shows how, quite consistently, organizations across different sectors are harnessing digital twins to innovate products and services within their ecosystems.

Healthcare Innovation through Digital Twins

In healthcare, optimizing care and clinical outcomes requires a deep understanding of the broader ecosystem in which patients live and how they access services, adhere to prevention initiatives and treatment plans, and what resources they need. To innovate care services, healthcare organizations need to collaborate with various stakeholders across multiple processes.

The European Commission’s VHT Initiative promotes digital twin technology in healthcare through research and deployment activity. This includes funding for computational models, infrastructures, and projects like the European Virtual Human Twin (EDITH), which among its objectives aims to create a federated cloud-based repository for cataloging resources and designing a simulation platform that provides users with a one-stop shop to design, develop, test, and validate digital twins for healthcare.

Transforming Supply Chains: The Case of Catena-X

New use cases are emerging, particularly in complex areas like supply chains. Digital twins can, for example, be used in vehicles and their components to map the entire value chain from creation to disposal and to improve parts traceability.

Catena-X, an open data ecosystem for the automotive industry, has been designed to ensure secure data exchange and data sovereignty among all stakeholders in a supply chain.

Based on the Catena-X framework, digital twins of vehicle components (e.g., battery modules/packs) can be utilized to facilitate the digital flow of information from battery manufacturers to vehicle OEMs and back.

The important thing here is that when data is exchanged between two parties, access is managed in a way that only reference information is shared. Part-specific data remains with the manufacturer.

IDC’s Cross-Industry Digital Twin Framework

As adoption rates rise and new use cases emerge, organizations must navigate the rapidly evolving landscape with strategic clarity. IDC offers a comprehensive framework to support industry-specific digital twin strategies.

The framework provides guidance on defining entities, systems, and processes eligible for digital twinning. We analyze market drivers, challenges, and benefits, and identify and analyze key industry use cases and examples of best practices.

Through tailored industry reports, IDC delves deep into digital twins across sectors like financial services, healthcare, and transportation (to mention just a few), providing insights and recommendations for transformative impact. For end users, the framework offers ready-to-use templates to assist strategy definition and market analysis. Tech providers can gain industry-specific insights to tailor offerings and drive adoption.

Download eBook: IDC’s Cross-Industry Digital Twin Framework: Where Innovation Meets Strategy

As the digital twin revolution unfolds, organizations must seize the opportunity to unlock the full potential of twins. Industry stakeholders must confidently navigate the complexities of digital twins to foster innovation, collaboration, and resilience within their organizations and across industry ecosystems.

Whether you’re just starting or are refining your approach, IDC Insights teams are eager to discuss your experiences and plans regarding digital twins across industries.

Transforming Waste into Profit: The Power of Remanufacturing Software

Supply chain disruptions — unpredictable supplies, product shortages, increasing material costs — continue to have a profound impact on manufacturers worldwide. In response, remanufacturing, which has long been a part of the industry, has seen a surge in popularity in recent years.

Companies are turning to remanufacturing as an alternative solution when they face challenges in procuring components or encounter skyrocketing prices. This approach not only helps address immediate supply chain issues but also fosters resilience and mitigates risks by prompting manufacturers to rethink their sourcing strategies and diversify their supply chains.

Moreover, remanufacturing is emerging as a key component of manufacturers’ sustainability strategies. Beyond its role in addressing supply chain disruptions, remanufacturing delivers significant environmental benefits. By reusing raw materials, it conserves resources and minimizes waste, contributing to a more sustainable use of resources.

Remanufacturing also promotes energy efficiency, reduces emissions, and embodies the principles of the circular economy, bolstering its appeal as a sustainable practice in manufacturing. As companies increasingly prioritize sustainability goals, remanufacturing is poised to play a crucial role in achieving these desired outcomes while also addressing supply chain challenges.

What is Remanufacturing?

According to the Remanufacturing Industry Council, “Remanufacturing is a comprehensive and rigorous industrial process by which a previously sold, leased, used, worn, remanufactured, or non-functional product or part is returned to a like-new, same-as-when-new, or better-than-when-new condition from both a quality and performance perspective, through a controlled, reproducible, and sustainable process.”

At the center of remanufacturing lies the concept of the “core.” The core refers to the existing, used, or worn-out part that serves as the starting point for the remanufacturing process. This core component undergoes a series of steps, including tracking, identification, disassembly, cleaning, inspection, repair, and reassembly, to transform it into a product or part that meets the desired quality and performance standards.

Effective core management is essential for manufacturers engaged in remanufacturing. It allows them to maximize the value of core assets, manage costs, and strengthen relationships with customers and suppliers. Additionally, robust core management practices help minimize waste and environmental impact by promoting the reuse of existing materials and reducing demand for new resources.

Closing the Gap: The Need for Remanufacturing Software

Remanufacturers in discrete manufacturing environments face distinct challenges that are not adequately addressed by traditional ERP systems. While ERPs offer essential functionalities like inventory management, testing, and quality control, remanufacturers require specialized core management features tailored to their needs, including:

- Core Tracking and Disassembly: Efficiently collect and inspect individual components or parts for wear, damage, or defects, ensuring thorough assessment and tracking throughout the remanufacturing process.

- Reconditioning, Repair, and Replacement: Address wear, damage, or defects in components through reconditioning or repair processes, or replace them with new or remanufactured parts as needed.

- Reassembly: Reassemble products according to technical specifications, ensuring that the final product matches the quality and performance of the original.

- Complex Product Configurations: Manage complex product configurations, accommodating a mix of old, new, or remanufactured components while maintaining accuracy and consistency.

- Cost Estimation and Pricing: Provide accurate cost estimation and pricing based on the type of components used, enabling transparent and competitive pricing strategies.

- Traceability and Compliance: Ensure traceability and compliance with regulatory requirements by generating reports and documentation necessary for regulatory purposes, maintaining transparency and accountability throughout the remanufacturing process.

- Integration Capabilities: Seamlessly integrate with other systems such as ERP or CRM, enabling data exchange and process synchronization across the organization.

By investing in specialized remanufacturing software, manufacturers can streamline operations, enhance productivity, and ensure compliance while effectively managing the complexities of the remanufacturing process.

Regional Approaches to Remanufacturing

Remanufacturing approaches vary across the globe, with each region displaying unique drivers and focus areas.

Primarily driven by cost savings but also influenced by federal/state regulations, the North American remanufacturing market is well developed. There is growing demand for remanufactured products across automotive, electronics, and aerospace.

In Europe, the growth of remanufacturing is closely tied to circular economy principles. With a strong emphasis on resource efficiency and waste reduction, government policies and initiatives play a significant role in driving adoption.

A key manufacturing hub, Asia holds immense potential to integrate remanufacturing practices into its industrial landscape. Technological advancements and a growing awareness of sustainability issues are driving the region toward embracing remanufacturing as part of its transition to a circular economy.

Cross-regional collaboration and knowledge-sharing initiatives are important for driving progress in remanufacturing practices globally. Leveraging insights and best practices from different regions can accelerate the adoption of remanufacturing and work toward achieving shared sustainability outcomes.

Guidance for End Users: Choosing the Right Remanufacturing Software

Selecting the right remanufacturing software is a critical decision, whether it’s an off-the-shelf (COTS) solution, customized, or a packaged solution offered by vendors. Regardless of the approach, the software should address the specific needs of remanufacturers while complementing existing systems and processes.

- Identify Your Unique Needs: Consider your remanufacturing business’ unique requirements, including core management, inventory control, quality assurance, cost savings, and regulatory compliance.

- Comprehensive Functionality: Look for solutions that offer a comprehensive range of functionalities, addressing core management challenges while also supporting traditional manufacturing processes.

- Ease of Use and Scalability: Prioritize solutions that are user-friendly and scalable to accommodate your business’ growth.

- Customization and Integration: Evaluate the software’s customization capabilities to tailor it to your specific remanufacturing workflow. Assess its integration capabilities to ensure smooth data exchange with other systems, such as ERP or CRM.

- Vendor Success Stories: Request case studies or success stories highlighting real-world implementations and measurable improvements achieved by other remanufacturing businesses. This can offer valuable insights into the software’s effectiveness and suitability for your needs.

- Road Map and Technological Advancements: Inquire about the vendor’s road map for future software developments and how they plan to incorporate the latest technological advancements such as automation, advanced analytics, and AI. Understanding the vendor’s commitment to innovation can help ensure that the software remains relevant and competitive in the long term.

By carefully considering these factors and collaborating closely with software vendors, end users can select remanufacturing software that not only addresses current challenges but also supports future growth and innovation in their operations.

Further reading: IDC MarketScape: Worldwide Remanufacturing Management Software 2024 Vendor Assessment

12 Essential Questions for Leaders in the Era of Disruptive Technologies

AI, which is poised to accelerate change more than any technology in history, has finally seized the CEO agenda. For those who viewed AI opportunistically, the introduction of generative AI (GenAI), along with the capabilities of large language models, is serving as a wake-up call to a new era.

According to IDC’s cross-industry Future Enterprise Resiliency and Spending Survey of January 2024, 37% of respondents globally believe GenAI will make a significant impact in the next 18 months. Nearly one-quarter said GenAI was beginning to disrupt their business, with 10% reporting it had already done so. Interestingly, these impacts are being felt most strongly by organizations in Asia/Pacific, followed closely by those Europe and the U.S.

Business competition remains fierce at the regional, national, and organizational levels. Conversations with numerous CEOs and senior managers about their approach to disruptive technologies, particularly AI and GenAI, prompted me to question whether leaders are asking themselves the right questions as they navigate this disruptive landscape.

Leaders of enterprises and medium-sized companies are adopting unique approaches. Some are enthusiastic about the potential productivity offered by innovative technologies. Others take a more cautious approach, advocating a measured strategy until the benefits of these technologies are proven on a broader scale.

This dichotomy often arises in discussions about emerging technologies like AI, cloud computing, and digital twins.

I’ve compiled a dozen key questions leaders should be asking as they guide their organizations through the dynamic — and potentially perilous — landscape of disruptive technologies:

- Recognizing Disruptive Technology

How can I determine whether it’s just buzz or a truly disruptive technology that our company can benefit from?

It’s crucial to develop a keen ability to distinguish between industry hype and genuinely disruptive technologies. This requires staying informed about emerging trends, engaging with industry experts, and fostering a culture that encourages innovative thinking.

- Building a Self-Learning Organization

How can I know if we have a self-learning organization whose organizational structure and processes enable us to identify, test, pilot, and objectively assess technology trends?

Organizational structures and processes must be assessed to ensure they foster a self-learning environment. This involves creating channels for identifying, testing, piloting, and objectively assessing technology trends within the company and promoting a culture of continuous learning and adaptation.

- Balancing Short- and Long-Term Focus

How can we benefit from new technology? Will a short-term focus jeopardize our competitive advantage?

Addressing immediate needs is crucial, but the long-term impact of new technology must also be evaluated. Embracing sustainable and forward-thinking strategies can help organizations avoid a myopic focus on short-term gains and instead build a competitive advantage.

- Data Protection and Cybersecurity

Personal productivity tools are great — but what about data protection and cybersecurity?

As organizations integrate personal productivity tools powered by AI, data protection and cybersecurity must be prioritized. Implementing robust measures to safeguard sensitive information is essential to reduce potential risks and ensure stakeholder trust.

- Technology Ecosystem

Do we need to be part of an ecosystem of technology vendors, advisors, and service providers?

Yes, it is critical to have access to a robust and versatile ecosystem of technology vendors, advisors, and service providers to navigate the complexities of emerging technologies. A collaborative approach enhances the organization’s capacity to understand, adopt, and integrate new technologies.

- Absorbing Innovation

How can I know if my organization has the ability to absorb another innovation? Will we need to create new dedicated positions, teams, or even departments?

Assessing the organization’s capacity to absorb new innovations is critical. Hence, it must be determined if your existing structures can accommodate technological changes or if dedicated positions, teams, or departments need to be created to facilitate a smooth integration.

- Avoiding Pilot Purgatory

In earlier technology deployment projects, we wound up parked in “pilot purgatory.” How can I know if we have learned from these experiences?

Another stop in “pilot purgatory” is possible if organizations haven’t learned from their previous technology deployment challenges. Organizations should establish clear guidelines and action plans for transitioning from pilot phases to full-scale implementation. This is vital to realize the full potential of tools like AI.

- Constant Change

Do our leaders need training to help them understand new paradigms and guide the organization in a world of constant change?

A continual education culture should be established to navigate the relentless change associated with emerging technologies. Such training would involve understanding new paradigms, learning how to foster adaptability, and creating a learning culture that supports leaders during times of uncertainty and rapid technological shifts.

- Balancing Human-Machine Collaboration

Who’s taking the lead: machines or humans?

Assess the roles of machines and humans within the organization. Striking a balance between automation and human involvement ensures harmonious collaboration that leverages the strengths of both, leading to increased efficiency and innovation.

- Regulatory Aspects

Should regulatory aspects be in our focus from the first discussions of the technology?

Prioritize regulatory considerations from the outset. Proactively addressing regulatory compliance ensures a smoother integration process and mitigates potential legal and ethical challenges.

- Contingency Planning

If we change or terminate technology at the company level, do we need a contingency plan?

A thoroughly prepared contingency plan should be in place when changing or terminating technology at the company level. This ensures minimal disruption and facilitates a smooth transition in case unforeseen challenges arise during the implementation or adoption process.

- Talent Management

How can I know if we have the talent to cultivate talent in the coming periods?

Focus on developing and retaining talent capable of driving technological advancement. This involves identifying, nurturing, and empowering individuals who possess the skills and mindset to lead the organization through the evolving landscape of AI and emerging technologies.

The Bottom Line

Being a leader who guides other leaders in transforming and revolutionizing industries and management domains demands a distinct set of skills and qualities, particularly the ability to pose the right questions — both to oneself and to the relevant stakeholders. Sometimes, despite our vantage point at the helm, we fail to anticipate the emergence of the next disruptive technology or product.

Some leaders might assert, “I rely on intuition, experience, and advisors to perceive what others cannot.” I advise caution. When it comes to leveraging technology adoption to gain a genuine competitive advantage, only a select few can keep pace with the relentless influx of new technologies.

It’s akin to a wild goose chase. But initiating the right discussions with yourself and your team can serve as a crucial starting point, potentially leading to the capture of flocks of opportunities!

3 Trends that Will Shape Partnering Ecosystems in 2024-25

The world of partnering has never been more complex. Vendor strategies are evolving faster than ever to keep pace with changing customer buying behaviors and partner business models.

Understanding how partner business models are evolving can help vendors build a partnering framework that is robust and flexible enough to reward partner activities while remaining customer-led.

Trend 1: Partners Are Deepening Commitment to their Strategic Vendor Partner

The breadth of a partner’s portfolio can provide an indication of the level of commitment a partner gives to each vendor relationship. Partners with multiple strategic vendor relationships are likely dividing their energy and resources between multiple vendors. Partners that work with just one, two, or three core vendors will likely give greater attention to each relationship.

This is important. While each vendor has visibility into what their partners are doing with them, they may not know how they are engaging with other vendors.

IDC’s EMEA Partner Survey 2024 showed that partners derive more than half of their total revenue from activities connected to their most strategic vendor partner. Just 6% of partners expect the share of revenue connected to their core strategic vendor to decline in the next 12 months, with 45% expecting it to remain at today’s level. Half expect it to increase.

For partners, there are specific benefits from concentrating resources on a single core vendor relationship. At the vendor level, demonstrating commitment can lead to the allocation of more resources, drive new business, launch new technologies, or to co-sell and co-creation activities that drive new customer wins.

For the partner’s business model, deep commitment to a specific vendor’s portfolio and road map can provide clarity in terms of future business development planning and skills development in the organization.

Trend 2: P2P Collaboration Accelerates Within Non-Linear Go-To-Market Motions

Partners traditionally seek to serve as a single point of contact for the end customer. The customer turns to the partner to procure, deploy, and service their IT environment.

However, changes in customer buying behavior and new routes-to-market and deployment models have led to the emergence of non-linear go-to-market motions in which multiple partners can be involved at different stages of a single customer’s journey.

Customers have choices in terms of how they procure, consume, and optimize their IT environments. They can involve a unique combination of marketplaces, platforms, and partners.

IDC’s EMEA Partner Survey 2024 shows that 60% of partner revenues are now direct payments from end customers. This means that 40% of partner revenue is coming from elsewhere — as a sub-contractor through another partner, fund disbursement from a marketplace operator, or payments from vendors.

Trend 3: Looking Beyond the Primary Activity of Partners

Many vendors used to categorize their partner base according to their primary activity. Partners that primarily focused on reselling vendor products and solutions were categorized as VARs. Partners that derived most of their revenue through services were labelled as some form of managed services or consultancy services provider.

Results of our survey suggest there are potential risks in this approach. Most partners now operate multiple partner business models that span sell, service, and build roles for the customer. While only a small number of partners in the survey self-identified as cloud service providers, for example, a significant number offer this as a secondary business model.

It is increasingly important for vendors to consider the activity mix of each individual partner to uncover how they engage with the customer. Vendors that only engage with a partner based on their primary business activity are potentially leaving opportunities on the table to drive additional customer engagement through other areas of expertise and capabilities the partner possesses.

Bottom Line

Gaining a deeper understanding of the activity mix and commitment levels of partners is key for vendors to allocate resources based on partner potential and to look for untapped opportunity within their existing partner base.

Knowing how your partners interact with other vendors and customers — and knowing how important you are to their overall business and what their long-term strategy is — has become critical to inform vendor ecosystem strategies.

To learn more, listen to IDC’s 2024 Channels and Alliances Predictions webcast, or reach out to discover how we can help unlock partner potential for vendors of all sizes.