How Tech Vendors in Europe Can Align Strategic Messaging for 2026

In Europe’s markets, strategic messaging must prove ROI and stay aligned across strategy, sales, analysts, and country GTM teams.

Strategic Messaging in Europe’s Markets

As 2026 planning accelerates, high-performing GTM teams at tech vendors across Europe know that campaigns alone won’t secure growth. They’re stress-testing positioning – not only for internal alignment, but for resonance with buyer expectations, stakeholder dynamics, and budget scrutiny.

The fundamentals of effective messaging remain constant across regions: clear strategy, ROI proof, and alignment across functions. In Europe, however, an added layer of complexity must be addressed: messaging needs to resonate across fragmented national markets, languages, and governance models while staying consistent for buyers.

What We’re Seeing from Top-Performing GTM Teams in EMEA

- Building from buyer economics, not brand preference

The strongest value narratives in 2026 are rooted in buyer economics. For European GTM teams, that means anchoring messaging in:

- Business outcomes tied to line-of-business KPIs

- Time-to-impact metrics that satisfy budget scrutiny

- Proof points that link product value to spend categories and investment decisions

IDC research shows that messaging built around use-case ROI increases renewal likelihood by 3.5x. For GTM teams competing across Europe, this ROI narrative must be credible at headquarters and adaptable in local markets.

- Aligning to who the buyer really is now

Your champion may still sit in IT or product, but the buying committee has expanded. In 2026, procurement, finance, RevOps, and CFOs will shape final evaluations – and their questions go beyond features and functions:

- How does this investment impact budget and efficiency?

- Where does it fit in the broader vendor stack?

- Does it align with compliance and operational resilience goals?

For European GTM teams, these dynamics don’t change, but multi-country decision-making adds friction. ROI messaging must stay consistent across borders, so what a buyer hears in Paris matches what they hear in Munich or London.

- Checking internal alignment before buyers do

Too often, what strategy wants to say, what sales are saying, and what analysts are reporting don’t fully align. That slows the buyer’s journey or stops it altogether.

In Europe, the risk of misalignment is multiplied:

- A message crafted centrally may not translate effectively in country execution

- Analyst commentary may highlight ROI drivers in one market that don’t match what buyers hear locally

- Country-level adaptations risk drifting unless anchored in a shared ROI-based strategic framework

Leading European GTM teams are addressing this by creating aligned narratives validated against external signals. That way, strategy, sales, analysts, and country teams reinforce each other rather than pulling apart.

Why It Matters for Tech Vendors in Europe

In fragmented markets, the risk isn’t messaging that’s “wrong.” It’s messaging that’s slightly off – between strategy, sales, and analysts, or between headquarters and local GTM teams.

The strongest European GTM teams in 2026 will be those that:

- Keep strategic alignment as their foundation

- Prove ROI under budget scrutiny

- Adapt to country-level nuance without losing consistency

IDC’s role as the Trusted Tech Intelligence provider is to help tech vendors validate and align these narratives — ensuring that what strategy defines, what sales delivers, and what analysts echo are all part of one coherent story across Europe.

Want a deeper checkpoint?

We recently published a new guide “5 Signals Your Messaging Won’t Win in 2026”. This guide outlines the most common and often hidden signs of misalignment we’re seeing in enterprise GTM efforts right now, along with steps you can take to course-correct using IDC data.

If you have a question about anything, please fill in this form.

IDC European Enterprise Communication and Collaboration Survey 2025: Growing Customer Demand for Choice and Flexibility

The IDC European Enterprise Communication and Collaboration Survey 2025 reveals increasing market segmentation in the UC space, as customers demand more choice and flexibility. This underlines the need for UC providers to evaluate their strategies and align more closely with evolving market trends. Below are the key findings from the European survey.

Businesses Demand Greater Choice and Flexibility

Most current UC offerings present binary, mutually exclusive choices that lock customers into a single platform. These options fail to address the full spectrum of business requirements, forcing organizations into trade-offs between critical capabilities such as transparency and control versus scalability and flexibility. As a result, many are unable to achieve their desired outcomes to the fullest extent.

A Resurgence of On-Premises Deployments

Cloud solutions provide scalability and eliminate upfront infrastructure costs, but some organizations are reverting to on-premises models to regain greater control and transparency over their IT environments. Regulatory constraints and geopolitical concerns — including the implications of the US Cloud Act — are driving this shift, particularly in sensitive verticals. However, this choice also involves trade-offs, with transparency and control being prioritized over flexibility. But it is not just reverting back to on-premises UCC – 60% across the board have stated that they will replace their existing solutions.

A New Era of Choice in Deployment Models

As customer demand for flexibility increases, the market is seeing greater segmentation and a shift away from traditional “either/or” approaches. Deployment models no longer need to be substitutes for one another. Instead, they can coexist, with each bringing unique, often irreplaceable value. Applications can now be decoupled from the underlying infrastructure, offering a wider range of hosting options across environments. This represents a market inflection point, where customers have more choice and flexibility to adopt solutions that best meet their needs.

Hybrid Deployments Are Becoming the Standard

Two-thirds of European businesses are already using multiple UC solutions across different deployment models to meet diverse requirements. While this hybrid approach enables organizations to capture the strengths of various models, it also introduces challenges — including higher maintenance costs, operational complexity, and integration issues. In the context of AI-driven automation, this creates opportunities for innovation to simplify hybrid environments and reduce complexity.

Strategic Implications for UC Providers

No single vendor can cover all requirements alone. A clear understanding of customer priorities, combined with close ecosystem collaboration, will be critical as the market continues to evolve. IDC’s European UCC research provides the insights needed to help providers align strategies with shifting customer needs.

If you have a question about anything, please fill in this form.

Marketplace Multipliers: Understanding Revenue Overlap in the Cloud Ecosystem

As cloud marketplaces continue to grow in scale and influence, they are reshaping how software is bought, sold, and delivered. For independent software vendors (ISVs), cloud platforms, and partners, marketplaces offer a streamlined route to customers, accelerated procurement, and new monetization models. But as this ecosystem matures, a subtle but important issue is emerging: the potential for revenue double-counting across the value chain.

The marketplace revenue flow

In a typical cloud marketplace transaction, a customer may purchase a SaaS or PaaS solution from an ISV via a private offer. That offer might be created by a distributor and fulfilled by a partner, while the ISV itself runs its solution on the same cloud platform that hosts the marketplace. Each party in this chain—partner, distributor, ISV, and cloud provider—may record the full transaction value as revenue or gross merchandise value (GMV), depending on their role and reporting model.

Where overlap occurs

The potential for double-counting arises when the same infrastructure spend is captured in multiple places. For example, an ISV may purchase infrastructure-as-a-service (IaaS) from a cloud provider to run its application. That same ISV may then sell its solution via the cloud marketplace, where the customer pays for the full SaaS offering—including the embedded IaaS costs. In this scenario, the cloud provider may record both the ISV’s IaaS consumption and the customer’s SaaS purchase as separate revenue streams, even though they are economically linked to the same infrastructure usage.

Estimating the impact

Our latest estimates suggest that up to 10–20% of reported marketplace revenue could be subject to some form of double-counting. This is particularly relevant in complex enterprise deals involving multiple intermediaries and multi-year commitments. The risk of overlap is higher in marketplaces with mature ISV ecosystems and transactional depth, where infrastructure and software are tightly coupled.

Implications for the ecosystem

This dynamic doesn’t imply wrongdoing—each party is legitimately recognizing revenue based on their role in the transaction. However, it does raise questions about how we measure the true size and growth of the cloud economy. Without careful deduplication and end-user-level spend tracking, there is a risk of overstating total IT spend, partner influence, and marketplace adoption.

Why it’s hard to fix

The challenge lies in the complexity of the ecosystem. Each participant has different incentives, reporting standards, and visibility into the transaction flow. Cloud providers may report gross marketplace volume, ISVs may report full contract value, and partners may claim influence or attach credit. Without a standardized framework for revenue attribution, it’s difficult to isolate and remove duplication.

A subtle signal

This isn’t a crisis—but it is a signal. As marketplaces become a larger share of enterprise IT procurement, the need for transparency and consistency will grow. For ISVs and cloud platforms alike, understanding where and how revenue is recognized can help avoid misaligned incentives and ensure sustainable growth. It’s something to be aware of as the ecosystem continues to evolve.

IDC’s EMEA Partnering Ecosystems team helps technology vendors, platforms, and ISVs navigate the evolving dynamics of cloud marketplaces and partner ecosystems.

Through continuous engagement with the ecosystem and proprietary survey data, we provide grounded, real-world insights into how value flows, where overlaps occur, and what it means for your go-to-market strategy. Whether you’re refining partner models, optimizing marketplace presence, or simply seeking clarity in a complex landscape, we can help. Get in touch to access the intelligence you need to make smarter, faster, and more efficient ecosystem decisions. For more information on the research, click here.

Listen to Stuart and Andreas’ webcast “The New Partner Playbook: Ecosystem-Led Growth in EMEA” register here.

If you have a question on this or anything related to partnering, please drop it here.

Digital Sovereignty in Europe in 2025: What’s “Plan B”?

Given all the geopolitical and economic upheavals so far seen in 2025, concerns about U.S. tech dominance, and fear of services from (non-European) IT providers being withdrawn as a result of government executive orders, the big question we keep hearing in Europe is “What is Plan B”?

I can answer that.

Firstly though, it should be noted that Europe’s interest in digital sovereignty has always been high. Now, as geopolitical tensions escalate and regulatory uncertainty deepens, many organisations on the continent see this as a strategic imperative.

But…

Geopolitical risk has typically been a low-ranking market driver for those seeking sovereign solutions in Europe. Sure, IDC’s 2025 Worldwide Digital Sovereignty Survey shows that this has climbed up the rankings, now attracting more than a quarter of responses compared to last year when it was slightly less and even coming bottom of the list of drivers as it has done so in the years prior to 2024.

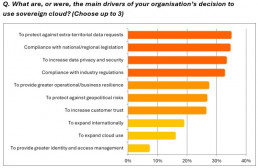

What’s more revealing is that Europe now has a new top sovereign cloud market driver: protection against extra-territorial data requests.

This reflects growing anxiety over foreign access to sensitive data and a clear signal that sovereignty is no longer just about compliance and control, but has a greater focus on autonomy.

The European provider’s response: “Plan B”

In what can be regarded as a largely unprecedented move, Europe’s service providers have reacted swiftly and have taken a proactive approach, joining forces to offer what they consider to be the “alternative” (and many also promote the idea of services, platforms and providers that can be labelled as “Made In Europe”).

Some examples here include EuroStack, which calls for a Europe-led digital supply chain spanning chips, cloud, AI and digital governance; virt8ra (pronounced virtoora), which is billed as Europe’s first sovereign edge cloud; and the EU-funded Sovereign European Cloud API (SECA) which is available to all European cloud providers for cloud infrastructure management.

These initiatives reflect a broader push to reclaim digital autonomy and reduce dependency on non-European tech giants.

The global cloud providers’ response: committed to Europe

The global cloud providers have not been standing still. And of course, none of them are about to walk away from their highly successful business operations in Europe.

In recent months, several big name providers, such as Google and Microsoft, have enhanced their sovereign offerings to emphasize how sovereignty and U.S. big tech can work provided the right controls and partnerships are in place.

And clearly, just as the global cloud providers are not planning to abandon Europe, Europe is not planning to abandon them.

For instance, despite all the media hype earlier this year around German authorities “ditching” Microsoft in favour of their own home-grown solutions (in June 2025, the German state of Schleswig-Holstein rolled out the OpenTalk videoconferencing solution, developed by Berlin-based Heinlein Support, across all state agencies), partnerships with U.S. providers continue to be announced.

These include the German Federal Office for Information Security’s (BSI) strategic cooperation agreement with AWS in the run-up to the launch of the AWS European Sovereign Cloud in Germany later this year.

Separately, the BSI has also teamed-up with Google Cloud to support the development and deployment of secure and sovereign cloud solutions for government agencies, including the German military that will use an air-gapped version of Google distributed cloud.

IDC’s response: Techxit? What techxit?

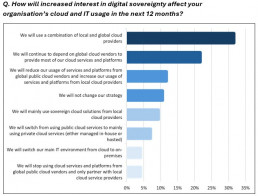

Despite their increased interest in sovereign solutions due to all the geopolitical turmoil, just 4% of European organisations say they plan to stop using cloud services and platforms from global public cloud vendors and only partner with local cloud providers.

Thus, reports of ‘techxit’ – the prospect of U.S. providers being forced out of Europe for whatever reason – are greatly exaggerated.

Instead, the dominant strategy is staying “glocal”: combining global innovation with local control by using both global and local providers, and many organisations in Europe say they will continue to depend on global cloud vendors.

What’s more, the idea of a full-scale “techxit” remains impractical, given the deep integration of global technologies in European IT environments.

Of course, it would be naïve to think that buyer expectations have remained unchanged in 2025 – far from it. The expanded interest in digital sovereignty in Europe is expected to account for a decrease in organisations using sovereign cloud from not only global providers but also their local counterparts, with managed providers seeing a slight increase. The changes here are not huge but significant enough for all providers to take not.

What all providers need to consider

To succeed in this evolving landscape, cloud providers must:

- Offer verifiable protections against extra-territorial data access

- Prioritize network sovereignty, including data in transit

- Invest in AI governance and compliance-first infrastructure

- Build regional partnerships to meet local expectations

- Embrace open standards to support interoperability and avoid vendor lock-in

So what is “Plan B”?

IDC has long maintained that a trusted ecosystem of partners is needed for sovereignty to work at scale, and we believe this should include a combination of using global and local providers.

For the global cloud players that means looking for the right regional and in-country partners to help boost local credibility and to deliver local services, local expertise and leverage local knowledge.

For the local service providers, it means partnering with global players to help deliver innovation and scalability.

And then the global SaaS providers need to be able to work across both to develop and deliver customized offerings within sovereign frameworks.

Europe’s vision for digital sovereignty is not about isolation — it’s about balance. The goal is to level the playing field, reduce dependency, and ensure that the continent can compete globally while retaining control locally.

Ultimately it’s about the sovereign aspect of digital self-determination and survivability and self-sufficiency. The latest geopolitical uncertainties indicate a recalibration of Europe’s cloud market, not a rejection of global providers.

So what’s Plan B? Our advice to organisations in Europe seeking sovereign solutions is to stick to Plan A.

For more information and to see what Rahiel is covering, look here: Digital Sovereignty.

Got a specific question? Drop it in here.